Summary: There have been megabytes of analysis of the Fed’s second quantitative easing program (QE2), most of which overlooks some important points. See the links at the end for more information.

Some important things to know about QE2:

- QE2 is a desperate act by the Fed

- Expect QE2 to be late, slow, and small

- Don’t expect big benefits

- Focus on the real threats; ignore fears of hypothetical dangers

- The amazing thing about QE2

(1) QE2 is a desperate act by the Fed

They call it unconventional monetary policy. A response to a slowing US (and global) economy after conventional policies have the banks glutted with idle reserves and brought short-term rates to near zero. After three years of economic stress, the debt-laden US economy cannot withstand another decline. And unless we have a crash, there will be no new fiscal stimulus programs to replace the fading American Recovery and Reinvestment Act of 2009 (see Wikipedia).

The US government will do QE2 because it has no other options, except prayer. We’re on a ugly path, as this graph from a recent Fed report shows:

(2) Expect QE2 to be late, slow, and small

The Fed telegraphs its actions, allowing investors to adjust — and test for adverse reactions before implementation. An announcement of QE2 was expected after the Fed’s September meeting. They punted it to the November meeting. Perhaps uncertain about the slowdown; perhaps fearful of becoming an issue in the elections (they’re not popular among Republicans, except among Republican bankers).

Some expect bold Fed action at its meeting on November 2-3, probably too late to prevent a second dip (any stimulus will take months to have visible effects). Disappointment is likely. Central banker DNA codes for a cautious nature, preferring reactive and incremental steps. If the economy continues to slow, we can expect one or two trillion dollars of purchases by the Fed (probably all Treasury bonds, but in its later phases they might buy corporate paper or mortgages).

(3) Don’t expect large good impacts

QE2 offers several benefits, in theory:

- boosting asset prices (e.g., stocks, real estate), stimulating consumer spending by the wealth effect (see Wikipedia)

- lower the value of the US dollar, improving US competitiveness and boosting exports

- lowering long interest rates, stimulating borrowing by households and businesses for consumption and investment

None of these are certain. We might get one of these on a significant scale; we might get none.

- Fed policies to boost asset prices has been a Fed staple since Greenspan; that game may be played out

- Exports are not sensitive to small changes in the value of one’s currency (income changes have greater effects), but large changes in the value of the dollar could destabilize the global economy

- Until demand and jobs revive neither will consumption nor investment, despite the modest rate changes from any likely Fed programs

Then there are the side-effects. Governments have done little to reduce the stress on the global economic machinery, which could snap at any time. Japan remains weak. The internal tension on the European Monetary Union builds, contained only by its people’s inertia and massive lending by the European Central Bank. And at the center lies the core problem: excessive US consumption and Chinese investment (a dysfunctional symbiosis).

For more information about this:

- “Would QE2 Have a Significant Effect on Economic Growth, Employment, or Inflation?“, Daniel L. Thornton, Economic Synopses (of the St. Louis Fed), 13 October 2010

- “Myron Scholes on Whether QE2 Will Work“, Wall Street Journal, 15 October 2010

- Why QE2 probably will do little: “Bernanke Leaps into a Liquidity Trap“, John P. Hussman, 25 October 2010

- “A little perspective on the impact that a weaker USD will have on overall economic activity“, Rebecca Wilder, 26 October 2010

- How QE programs work: “Is More QE in Sight?“, Richard G. Anderson, Economic Synopses (Federal Reserve Bank of St. Louis), 28 October 2010

(4) Focus on the real threats; ignore fears of hypothetical dangers

Fears — hysteria, even — about inflation and hyperinflation fill the media (print and electronic). It’s typical of societies with broken minds (OODA loops). Fire extinguishers in hand as the flood waters rise. Building dikes as the crops burn. And today, raising alarms about inflation as the Fed implements QE2, desperately seeking to prevent more deflation. Prices indexes are declining in most developed nations. Loan default rates remain high in many nations, threatening cycles of debt deflation (go here for an explanation).

Nor will a fall in the US dollar ignite US inflation (unless it collapses, in which case inflation will be amongst the least of our problems): “Does a Fall in the Dollar Mean Higher U.S. Consumer Prices?“, Federal Reserve Bank of San Francisco, 13 August 2004.

Real estate is the core of the deflationary storm. Massive government aid has stabilized home prices; but they might be coming unstuck: “Clear Capital Reports Sudden and Dramatic Drop in U.S. Home Prices” — down 5.9% during the past 2 months. The commercial real estate market looks less healthy: -4.0% in June, -3.1% in July, -3.3% in August (down 7.6% YTD thru August; down 45% from October 2007 peak). See the graph:

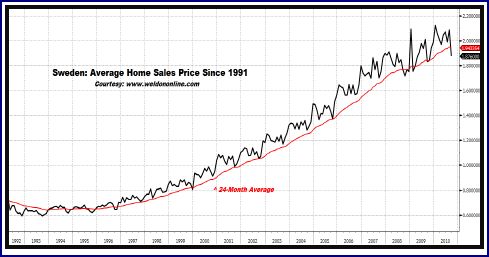

It’s afflicting many developed nations.

For more information about deflation:

- “U.S. Historical Experience with Deflation“, Christopher J. Neely, Economic Synopses (of the St. Louis Fed), 1 October 2010

- “Bernanke Battles U.S. Deflation Threat“, John H. Makin, American Enterprise Institute, November 2010

(5) The amazing thing about QE2

The amazing thing about QE2 is our complacency about it. A desperate move taken to avoid a perilous economic decline, with few (or no) precedents of success. The rational response would be caution or concern. Fear or panic would be unseemly but warranted.

For More Information

Articles:

- “Economic Outlook and the Current Tools of Monetary Policy“, Narayana Kocherlakota (President, Federal Reserve Bank of Minneapolis), 29 September 2010 — “Each of these tools has benefits and drawbacks that must be balanced against each other. With QE, I would say that the multiple effects make the calculus even more difficult than usual.”

- “The Fed is right to turn on the tap“, Martin Wolf, op-ed in the Financial Times, 9 November 2010 — “The sky is falling, scream the hysterics: the Federal Reserve is pouring forth dollars in such quantities that they will soon be worthless. Nothing could be further from the truth. As in Japan, the policy known as “quantitative easing” is far more likely to prove ineffective than lethal. It is a leaky hose, not a monetary Noah’s Flood.”

Posts about deflation:

- Debt – the core problem of this financial crisis, which also explains how we got in this mess, 22 October 2008

- A situation report about the global economy, as the flames break thru the firewalls, 26 January 2009

- Inflation or Deflation? Nobody knows what path will we take., 21 July 2009

- Economic theory as a guiding light for government action in this crisis, 10 March 2009

- Fetters of the mind blind us so that we cannot see a solution to this crisis, 1 April 2009

- A lesson from the Weimar Republic about balancing the budget, 10 February 2010

- All about deflation, the quiet killer of modern economies, 19 July 2010

“The Fed is right to turn on the tap“, Martin Wolf, op-ed in the Financial Times, 9 November 2010 — Worth reading in full. Excerpt:

Two articles about the danger of inflation from large-scale growth of the money supply, debunking the hysterical fears of certain inflation.

(1) “The Correlation between Money Base Growth and Inflation“, Menzie Chinn (Prof Economics at U of Wisconsin, Madison), Econobrowser, 7 December 2010

(2) “Doubling Your Monetary Base and Surviving: Some International Experience“, Richard G. Anderson, Charles S. Gascon, and Yang Liu, Review of the Federal Reserve Bank of St. Louis