Summary: The European Court of Human Rights shows America that the love of justice still lives there, finding Macedonia guilty of the crime of cooperating with CIA crimes. Slowly what was a city on a hill (Matthew 5:14) sinks into the mud. Slowly our global leadership erodes, leaving just another military power (funded by loans from Japan and China).

.

Content

- Summary of the case

- The Court’s ruling

- America responds: secrets trump justice

- More about this episode of our history

- For More Information about justice in America

This is another in a series of posts about the death of justice in America. Links to the others appear at the end.

.

(1) Summary of the case

From “Torturing the Wrong Man“, Amy Davidson,

The New Yorker, 13 December 2012

A judgment issued on Thursday by the European Court of Human Rights contains an account of the treatment of a man who, after some detective work by a foreign police force, was handed over to the CIA as suspected member of Al Qaeda …

Why would someone with such dangerous connections be released? What about the information he might have that could unravel some devious plot?

The answer is simple: after a couple of months, the C.I.A. figured out that they had picked up not a shadowy terrorist but a car salesman from Bavaria who happened to have a similar name. Even then, they kept him prisoner for several weeks while trying to figure out their next move. There is now no dispute that this was a case of simple mistaken identity.

(2) The ruling

Excerpt from a Decision by the European Court of Human Rights, 13 December 2012:

.

In today’s Grand Chamber judgment in the case of El-Masri v. “the former Yugoslav Republic of Macedonia”, which is final, the European Court of Human Rights held, unanimously, that there had been:

- a violation of Article 3 (prohibition of torture and inhuman or degrading treatment) of the European Convention on Human Rights on account of the inhuman and degrading treatment to which Mr El-Masri was subjected while being held in a hotel in Skopje, on account of his treatment at Skopje Airport, which amounted to torture, and on account of his transfer into the custody of the United States authorities, thus exposing him to the risk of further treatment contrary to Article 3;

- a violation of Article 3 on account of the failure of “the former Yugoslav Republic of Macedonia” to carry out an effective investigation into Mr El-Masri’s allegations of ill-treatment;

- violations of Article 5 (right to liberty and security) on account of his detention in the hotel in Skopje for 23 days and of his subsequent captivity in Afghanistan, as well as on account of the failure to carry out an effective investigation into his allegations of arbitrary detention;

- a violation of Article 8 (right to respect for private and family life); and,

- a violation of Article 13 (right to an effective remedy).

The case concerned the complaints of a German national of Lebanese origin that he had been a victim of a secret “rendition” operation during which he was arrested, held in isolation, questioned and ill-treated in a Skopje hotel for 23 days, then transferred to CIA agents who brought him to a secret detention facility in Afghanistan, where he was further ill-treated for over four months. The Court found Mr El-Masri’s account to be established beyond reasonable doubt and held that “the former Yugoslav Republic of Macedonia” had been responsible for his torture and ill-treatment both in the country itself and after his transfer to the US authorities in the context of an extra-judicial “rendition”.

Principal Facts

The applicant, Khaled El-Masri, a German national of Lebanese origin, was born in 1963 and lives in Ulm (Germany). According to his submissions, having arrived in “the former Yugoslav Republic of Macedonia” by bus on 31 December 2003, he was arrested at the border crossing by the Macedonian police. They took him to a hotel in Skopje, where he was kept locked in a room for 23 days and questioned in English, despite his limited proficiency in that language, about his alleged ties with terrorist organisations. His requests to contact the German embassy were refused. At one point, when he stated that he intended to leave, he was threatened with being shot.

On 23 January 2004, Mr El-Masri, handcuffed and blindfolded, was taken to Skopje Airport, where he was severely beaten by disguised men. He was stripped of his clothes, then sodomised with an object and later placed in a nappy and dressed in a tracksuit. Shackled and hooded, and subjected to total sensory deprivation, he was forcibly taken to an aircraft, which was surrounded by Macedonian security agents. When on the plane, he was thrown to the floor, chained down and forcibly tranquilised. According to Mr El- Masri, his treatment before the flight at Skopje Airport, most likely at the hands of a rendition team of the CIA, was remarkably consistent with a subsequently disclosed CIA document describing so-called “capture shock” treatment.

Mr El-Masri was flown to{Afghanistan}. According to his submissions, he was kept for over 4 months in a small, dirty, dark concrete cell in a brick factory near Kabul, where he was repeatedly interrogated and was beaten, kicked and threatened. His repeated requests to meet with a representative of the German Government were ignored. During his confinement, in March 2004, Mr El-Masri started a hunger strike to protest about being kept in detention without charges. In April, 37 days into his hunger strike, he claims that he was force-fed through a tube, which made him severely ill and bedridden for several days. In May 2004, he allegedly started a second hunger strike.

On 28 May 2004, he was taken, blindfolded and handcuffed, by plane to Albania and subsequently to Germany. Mr El-Masri then weighed about 18 kilos less than a few months earlier when he had left Germany. Immediately after his return to Germany, he contacted a lawyer and has brought several legal actions since. In 2004, an investigation was opened in Germany into his allegations that he had been unlawfully abducted, detained and abused. In January 2007, the Munich public prosecutor issued arrest warrants for a number of CIA agents, whose names were not disclosed, on account of their involvement in Mr El-Masri’s alleged rendition.

A claim filed in the United States in December 2005 by the American Civil Liberties Union on Mr El-Masri’s behalf against the former CIA director and certain unknown CIA agents was dismissed. The court decision, which became final with the US Supreme Court’s refusal to review the case in October 2007, stated in particular that the State’s interest in preserving State secrets outweighed Mr El-Masri’s individual interest in justice.

… There have been a number of international inquiries into allegations of “extraordinary renditions” in Europe and the involvement of European Governments, which have referred to Mr El-Masri’s case. In particular, in 2006 and 2007, the Committee on Legal Affairs and Human Rights of the Parliamentary Assembly of the Council of Europe, under the rapporteurship of Senator Dick Marty of Switzerland, investigated those allegations. The 2007 Marty Report concluded that Mr El-Masri’s case was “a case of documented rendition” and that the Macedonian Government’s version of events was “utterly untenable”. The report relied in particular on the following evidence: …

—————————————–

(3) America responds: secrets trump justice

And the Founders wept. “Federal Judge Dismisses Lawsuit by Man Held in Terror Program“, New York Times, 19 May 2006:

A federal judge on Thursday dismissed a lawsuit brought by a man who says he was an innocent victim of the United States government’s program transferring terrorism suspects secretly to other countries for detention and interrogation.

Judge T. S. Ellis 3rd ruled in favor of the Bush administration, which had argued that the “state secrets” privilege provided an absolute bar to the lawsuit against a former CIA director and transportation companies. Judge Ellis said the suit’s going forward, even if the government denied the contentions, would risk an exposure of state secrets.

… US officials have acknowledged the principal elements of Mr. Masri’s account, saying intelligence authorities may have confused him with an operative of Al Qaeda with a similar name. The officials also said he was released in May 2004 on the direct orders of Condoleezza Rice, then the national security adviser, after she learned he had been mistakenly identified as a terrorism suspect.

(4) More about this episode in our history

- “European Court: U.S. Extraordinary Rendition ‘Amounted to Torture’”, Allison Frankel, ACLU, 13 December 2012

- “Arrest All Torturers“, Joe Giambrone, CounterPunch, 18 December 2012 — “Is this a Nation of Laws, or of Unaccountable Men – and Women?”

(5) For More Information

- Sparks of justice still live in America – cherish them and perhaps they’ll spread, 11 September 2009

- Code red! The Constitution is burning., 5 August 2010 — Judges pretend blindness to the hit on Anwar al-Awlaki

- Another American judge weakens the Republic’s foundation, 8 August 2010

- Why should we care about the Supreme Court’s ruling allowing strip & cavity searches of prisoners?, 5 April 2012

- Freedom and justice, evicted from America, may have found a new home, 17 August 2012

- The NDAA shows that justice is blind in America, but in a bad way, 9 October 2012

.

.

F -111/ h

Sent from my iPhone

The title is premature.

Many investigations have been going on for a long time in several European countries involved in extraordinary renditions (Poland, Ireland, Germany, Romania, Sweden, etc, etc). They have all stalled or been abandoned; the few ones still being actively pursued have yet to lead to any kind of process. Italy is an exception — and none of the perpetrators of that famous abduction affair cum spending spree by CIA operatives has ever met his well-deserved punishment. Idem for Macedonia.

No, justice is still wandering without a home.

I’ll agree that the El-Masri trial unfortunately seems to be the exception, not the rule. My government (Denmark) was found to be complicit in renditions and providing fuelling facilities in both Greenland and Copenhagen to unmarked CIA-planes. An enquiry was held where the government whitewashed itself and authorities in the Danish Commonwealth nations of Greenland and the Faroe Islands. It’s conclusions was that authorities did not know of any rendition flights and because of a lack of information (primarily because of US unwillingness to answer questions) it cannot be confirmed nor denied that such rendition flights occurred.

Subsequently, thanks to wikileaks, papers have come to light that points at collusion between the Danish and US governments in obfuscating either’s role in rendition flights, which has made the Greenland government call for an independent review in 2011, which is still ongoing.

From the Danish Ministry of Foreign Affairs (in Danish)

Rune,

Thanks for this comment. Such matters are little reported in the US.

Slightly off the subject but it harks back to your article on British counterinsurgency tactics – The British take torture much more seriously that we in the United States. From BBC, a report of a British physician who examined a Afghani detainee who was tortured to death by British soldiers in 2003. He did not report it to superiors and has just lost his privileges to practice medicine in the Britain National Health Service. (BBC, 21 December 2012)

Meanwhile in an article in the NY Times on acting CIA director criticizing torture in movie, Zero Dark Thirty, we have this quote calling waterboarding legal

Mr. Rodriguez is technically correct in that the court case deciding that waterboarding is illegal has not taken place. There was a case where waterboarding was held to have deprived a detainee in Texas of his right to not incriminate himself. But the act itself has not been made illegal.

SDW,

Thanks for reminding us of these things! Here’s some additional information about the points you raise.

(1) Brits proving more dedicated to the values of western civilization than Americans

Agreed! And not just today. See We close our eyes to torture by our government. The Brits are stronger., 9 April 2009.

(2) “Jose A. Rodriguez Jr., who oversaw the agency’s counterterrorism operations when the methods were in use, wrote in The Washington Post that the hunt for Bin Laden ‘stemmed from information obtained from hardened terrorists who agreed to tell us some (but not all) of what they knew after undergoing harsh but legal interrogation methods.'”

The evidence is quite strong, from multiple sources, that Rodriguez is lying. Why would anyone expect a torturer to tell the truth about his actions?

(3) “Mr. Rodriguez is technically correct in that the court case deciding that waterboarding is illegal has not taken place.”

I disagree. While US courts since 2001 have abandoned their responsibility and deferred to the US government in these cases, US Courts and US-sponsored Courts have in the past clearly ruled that waterboarding is torture and illegal.

“Drop by Drop: Forgetting the History of Water Torture in U.S. Courts“, Evan Wallach, Columbia Journal of Transnational Law, May 2007 — Excerpt:

Contrast the Brit doctor losing his license for not reporting torture to US Medical Associations not acting against doctors assisting torture.

See “More symptoms of decay: professional associations abandoning their standards and obligation to protect us“, 4 May 2011.

correction to previous comment – BBC reported It was an Iraqi detainee.

[quote]They took him to a hotel in Skopje, where he was kept locked in a room for 23 days and questioned in English, despite his limited proficiency in that language, about his alleged ties with terrorist organisations.[/quote]

I find this point tragic and absurd. Not only did they torture this guy, but they questioned him in a language that he couldn’t speak. This is a caricature of the American abroad, never learning the language. That if English is spoken in a loud voice, combined with torture and sodomy that they’ll understand. Obviously if the US Government was actually interested in information, it could have found an interpreter. I think more likely that the US Government here wasn’t interested in information, but was rather looking to satisfy its own need for sadistic pleasure.

Cathryn remarks: “Not only did they torture this guy, but they questioned him in a language that he couldn’t speak.” Of course they did. That’s the whole point.

The function of torture is not to elicit information — every military intelligence professional knows that torture is worthless for obtaining actionable intel. The purpose of torture is social control. America has become a torture nation because the 1% have launched a putsch, and there are so many more of us (poor and middle class people) than them (the rich) that the only way to maintain control of such a society with so grossly unequal a distribution of wealth is to torture some innocent victim every once in a while as a message to the rest of the peons.

The message is clear. “Today, we’re torturing brown-skinned people who did things we didn’t like. Shut up and toe the line, Americans, because tomorrow we might be torturing lily-white citizens who do things we don’t like.”

“tomorrow we might be torturing lily-white citizens who do things we don’t like.”

There is a strong case that this has already taken place with Bradley Manning.

guest,

That’s a powerful point. We might have crossed a line in the past few years. I think we see that in the applause for Zero Dark Thirty.

Re: “…military power (funded by loans from Japan and China)…”

How is the US funded by loans from our imports? They are exchanging hard goods for our currency? Not only that they like our currency so much that they put in saving accounts to earn interest (i.e. treasury paper). The US issues its own currency, which is essentially a cyber currency, and pays the interest on its government paper with a simple key stroke. See Bernanke’s and Greenspan’s remarks on these points and to the effect that the US, by definition, as an issuer of its own currency, cannot run out of the currency nor is it using taxpayer’s money. How can the US government be said to need taxpayer’s money when all the assets in the private sector, including state and local governments, originated from the issuer of the currency in the first place? Taxpayers are users of the monopoly currency, and the federal government is the issuer. What counts towards establishing the value of a currency is the productive power of the economy of which it is the token. Is the country stable, does it have a reliable system of courts and contracts, are the people skilled, is there an adequate infrastructure, and so on? The US is not “funded” exogenously; again,it issues its own currency.This is not “theory,” it is simple concrete fact, easily verifiable. The dollar is a non-convertible, free-floating currency, and has been such since the end of Bretton Woods. The plutocracy is perfectly aware of all this and its implications, but it suits its purposes to have the politicians either ignorant or playing ignorant, as in Obama’s declaration that we are “out of money,” which is literally nonsense in the strict sense of the word–these politicians, along with the slavish corporate media, are either what the communists used to call “useful idiots” or else simply bought and paid for shills.

It’s astonishing how quickly has spread the belief that the government can monetize debt without consequences.

James shows this, grossly misrepresenting basic economics — as in work of Greenspan and Bernanke. Even the economists advocating Modern Monetary Theory don’t make such claims.

But as we see so many times in history, the needs of the times evoke theories that tell people what they want to hear. In our case, after decades of warnings about the imprudent accumulation of debt, theories arise that we can borrow without worry.

Let’s hope this works itself out better than past delusions, without tears.

Oh, the government absolutely can monetize debt without consequences… it’s been doing so since we went off the gold standard.

What it can’t do is to mismanage taxation or spending without consequences. Monetizing the debt is frequently used as an excuse to allow continued mismanagement of taxation and/or spending — for instance, taxing only the poor (not the rich) or spending only on the rich (not the poor).

“the government absolutely can monetize debt without consequences… it’s been doing so since we went off the gold standard.”

Please cite evidence, as it appears you are just making stuff up. There are discussion-oriented websites by the thousands where you can spout off whatever you like. These posts cite reliable sources. You need not agree, but are held to the same evidence-based standard.

“the government absolutely can monetize debt without consequences… it’s been doing so since we went off the gold standard.”

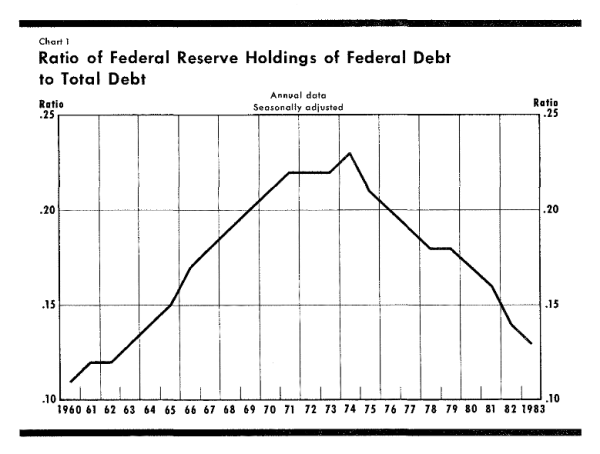

Neither part of that sentence is correct. Let’s look at the latter part, which is wrong in two senses. That’s easily seen in this graph from “Monetizing the Debt“, Daniel L. Thornton, Federal Reserve Bank of St Louis, 1984. The rising line shows the Fed owning an increasing fraction of the US government’s debt. It rose after WWII, peaking shortly after Nixon ended the last convertibility of the US dollar to gold in 1971. The Fed’s ownership share of gold then declined through the long years of disinflation.

.

.

Other useful articles explaining monetization:

Fabius, I assure you I am not misinterpreting MMT, nor am I advocating something that doesn’t exist, namely “monetizing the debt.” You are thinking in pre-Bretton Woods terms.

Please tell me which sentence you think is misrepresenting MMT. The gov’t is the issuer of its currency. True or false? The government spends this currency into the government–either directly or through its agents, the banks, creating assets in the private sector. True or false? The total amount in the deficit column in the national accounting book is equal to the penny the amount in the asset column held in all the private accounts, including foreign accounts. True or false?

Not only is there the crucial distinction between the sovereign monopoly issuer of the currency and the users of the currency, there is also the crucial distinction between federal debt and private debt (including state and local governments). Paying off federal debt, when it is denominated in its own currency (which our federal debt is), of which it is the issuer, is by definition a non-problem. It amounts to changing numbers in accounts using computers. It is done every day. Our private debt is a very big problem, much of it due to accounting fraud (see Bill Black’s work at New Economic Perspectives).

The government doesn’t have to earn its own currency to pay its debts denominated in its own currency; this should be obvious. Users of currency do have to earn dollars to pay their debts–local governments do so either by taxation or by creating new debt in the form of bond issues and so on, and private business does so by production of goods and services. The federal government does not have to tax in order to spend; it taxes for two fundamental reasons: to create the legal basis for its currency and to withdraw assets from the private sector in cases where inflation threatens (we are very far from this situation; we have a deflationary situation, and the government needs to spend more and reduce taxes so as to increase spending power (aggregate demand) in the private sector. It is not doing that, obviously, and you can see the dismal and the potentially even dangerous result.

I recommend Warren Mosler’s “The 7 Deadly Innocent Frauds” (free download at his site) and “Soft Currency Economics (Kindle book). You can also follow the writing at NewEconomicPerspectives.com and also Bill Mitchell’s Blog here: to keep abreast of the main writers MMT. Mike Norman also has an excellent blog at mikenormaneconomics.blogspot.com.

Regarding the idea of “monetizing the debt,” here is a good explanation by Bill Mitchell: “More neo-liberal atrocities from the Fourth Estate“, 26 May 2008. Also here: “Questions and answers 1”

===============================

I should add that I sent my posts to Warren Mosler himself before making this last reply to assure you that I am not misrepresenting MMT. Here’s how I started my letter to him:

Warren inserted the following remark here:

He also made the following two additions to phrases in my first post; I’ve put them in parentheses:

How can the US government be said to need taxpayer’s money when all the (dollars) assets in the private sector, including state and local governments, originated from the issuer of the currency (or its designated agents) in the first place?

What counts towards establishing the value of a currency is the productive power of the economy (value is a function of what govt. makes you do to get it.)

He made no additions to this, my last post.

James,

We have gone over this too many times to do again. There are several threads on these, including two posts by economists Ed Dolan.

Even economists advocating MMT agree with the mainstream that inflation and currency are boundaries for monetization. The question, as so often the case in economics, concerns when and how, magnitudes and circumstances.

I have found it a waste of time to discuss these 101 level aspects of science with people. Will the Earth become like Venus? Can the government print money without practical limit? No. No.

There are many good textbooks explaining these things, and I will leave it at that. Or, if you prefer, look at the posts about MMT here.

Inflation is triggered by money chasing too few resources. The tradeoff is between inflation and resource constracts (whether peak oil or full employment).

Yes, this is a constraint on money-printing, but a rather obscure one which comes up almost never — especially since nobody minds inflation as long as it’s below hyperinflation levels.

Inflation is a very real constraint, and has frequently been so during the past few generations. It is a commonplace in third world nations, and was a major political factor in most of the developed nations during the 1970s (eg, see Volker).

I just made a big typo here:

The government spends this currency into the government

It should read “into the economy.”

Another important aspect to the federal and private debt distinction. As Mosler says, “The financial sector is a lot more trouble than it’s worth.”

“America’s Deceptive 2012 Fiscal Cliff“, by MICHAEL HUDSON, CounterPunch, 28 December 2012 — “How Today’s Fiscal Austerity is Reminiscent of World War I’s Economic Misunderstandings”

“The financial sector is a lot more trouble than it’s worth.”

Wow. That is one of the more remarkable over statements I have ever seen. Bizarre. The financial sector was created several millennia ago, and has proven itself to be a useful part of civilization.

Like so many other things, useful when properly integrated into society. Which we do by a wide range of political mechanisms. Unfortunately, these are not working adequately at present.

But baby, bath water, etc…

Not so sure about that, Fabius. Contrast ancient Sumeria (which had a financial sector) with ancient Egypt (which didn’t, and used a system of central planning and state-set barter ratios). By all accounts, ancient Egypt was a nicer and more humane place to live. Also richer.

I specifically said “recent generations”. The monetary systems of the ancient world are of near-zero relevance to today’s economic dynamics.

James is correct, Fabius. Like it or not. You do not answer any of his pertinent questions that relate to the operational facts of our monetary system (different from that of the currenty Euro system). And the end of the Bretton Woods agreement is a crucial point–our system hardly dates back to thousands of years. It is post-Bretton Woods. This is actually pretty elementary stuff.

There are two aspects to MMT. The one James is echoing is not prescriptive it is simply descriptive. It is a description of how the system actually works, comparable to a description of how your computer works, or how any given objective process works. It’s just not debatable. “Objective” and “operations” are the operative words here. A technical explanation of central bank operations by another MMT expert, Scott Fulwiler, is here

“Modern Central Bank Operations – The General Principles“, Scott T. Fullwiler (Wartburg College), 1 June 2008

and another about the workings of the monetary system is here: “Modern Monetary Theory – A Primer on the Operational Realities of the Monetary System“, Scott T. Fullwiler (Wartburg College), 30 August 2010

I think that if you are going to pronounce on MMT that you should study the foundational documents, rather than relying on your personal judgments. James’ recommendations are a good place to start. You clearly have not studied them. There is also a raft of material at the Levy Institute. But “Soft Currency Economics” is essential reading. If you haven’t read it you really have no right to pronounce on the subject.

Did you read Hudson’s article, Fabius, or are you reacting and shooting from the hip? It’s a very insightful article, and Mosler’s comment, inserted by James, is quite apropos. Mosler, one of the founders of MMT, along with Mitchell and Wray, is an absolute expert on the banking syste with decades of experience in the financial sector, is also the owner of a bank, and is a multi-millionaire to boot. He knows what he’s talking about first-hand. His remark, like all synthetic statements, should be understood in context.

Hudson’s article is great, as usual. Mosler’s comment is bizarre, as it was posted — as a stand-alone comment. I don’t care how super-duper its author.

Additional note, although absurd that it needs saying — Everybody says absurd things now and then. Jefferson said many things that were really out there. It’s just life.

Fabius, why are you putting words in my mouth? I’m not stupid, and I do not base my knowledge of MMT on second-hand sources like Dolan. The distinction to be made here is is that the government literally has no operational constraint on its ability to spend, for the very simple reason that it is pegged to a commodity, it is not convertible, nor is ti pegged to another, foreign, currency. I never said, nor would I ever say, that it has no economic constraint. If you’d taken the trouble to read my post carefully, and if you understood MMT, you’d have deduced that from my statement concerning the function of taxes in a fiat regime; precisely one of them–as I specify–is to avoid inflation when an economy threatens to “overheat”–when it is operating at full employment and productive capacity and yet the government continues to spend into it. The remedy for inflation is always essentially two-fold: reduce government spending and/or increase taxation, that is, reduce aggregate demand.

I think your comment is both disobliging in its tone and patronizing language and gratuitously underestimates me as an interlocutor.

James,

I made two comments:

You summarized these as “He wrote back that I misrepresented MMT because I was advocating ‘monetizing the debt.’” That’s not remotely accurate. Not only did I not say that, but monetizing the debt is a conventional monetary policy. The Fed has bot a trillion of Treasury debt, for conventional reasons.

If you disagree with my two statements, fine. They’re not things I’m interested in debating. Certainly not now.

Also: you might find it worthwhile to read the posts about MMT. You’ll see I provide ample references for anyone interesting in learning about it. Also, you’ll see that these issues were debated at extreme length.

Another typlo: for the very simple reason that it is pegged to a commodity,

should be it is not pegged to a commodity,nor is it pegged to another foreign currency.

Deprogramming Progressives Indoctrinated into Supporting Austerity

http://neweconomicperspectives.org/2012/12/deprogramming-progressives-indoctrinated-into-supporting-austerity.html#comment-84353

—————————

Another good video.

George,

These videos about MMT are very off topic to this post. Please post only relevant material. There are many posts on which these videos would contribute. But not this post.{It’s too late to keep the thread on-topic}George,

Scrap my previous comment. You were following the thread, which was hijacked by MMT advocates. Topic drift strikes again.

“Fiscal Cliff: Going Nuclear and the Grand Betrayal“, The Real News, undated — “Bill Black: GOP threatens to use debt ceiling as leverage, creates conditions for more austerity measures by Obama”

.

http://youtu.be/52vFiXzW6NY

How can you say that James hijacked your thread when he was commenting on something you wrote on it; and when in your reply you accused him of “grossly representing” something which he actually describes with accuracy, even to the point of receiving approbation from the top MMT expert, Warren Mosler? He thus had a perfect right to defend himself, subsequently–and George obviously felt the same way–and you don’t have the decency to tender an apology or admit your deficiency! It is obvious you don’t know the subject well, that you don’t read posts thoroughly when they go against what you believe or like, and that you lack common courtesy in your replies in such cases, and in addition that in so acting you exhibit a degree of intellectual dishonesty.

“He thus had a perfect right to defend himself”

Quite right.

“Topic drift” is not a capital crime. It’s business as usual here, as elsewhere on the Internet. These are like conversations in pubs, and they drift where they will.

Stephen,

(1) “and when in your reply you accused him of “grossly representing” something which he actually describes with accuracy, even to the point of receiving approbation from the top MMT expert”

I think you have a reading FAIL here. Let’s replay the tape.

James: “See Bernanke’s and Greenspan’s remarks on these points and to the effect that the US, by definition, as an issuer of its own currency, cannot run out of the currency nor is it using taxpayer’s money. {more in this vein}”

I replied: “It’s astonishing how quickly has spread the belief that the government can monetize debt without consequences. James shows this, grossly misrepresenting basic economics — as in work of Greenspan and Bernanke. Even the economists advocating Modern Monetary Theory don’t make such claims.”

And further: “Even economists advocating MMT agree with the mainstream that inflation and currency are boundaries for monetization. The question, as so often the case in economics, concerns when and how, magnitudes and circumstances.”

I give two specific assertions.

(a) James’ claims about Bernanke and Greenspan

I don’t believe James has even defended these (ie, no mention of those names). They, like most “freshwater” economists, are wary of large-scale monetization (of the scale James mentions). It’s an option, one of the many forms of what’s called “soft default”.

(b) My characterization of MMT

I don’t recall seeing anything by James refuting my characterization of MMT, at least MMT as described by the folks at NEP {but I might have missed it}. In the MMT threads on the FM website there are references aplenty supporting what I said here. Later in his comments James himself appears to agree with me wrt inflation.

(2) “point of receiving approbation from the top MMT expert, Warren Mosler?”

I don’t see anything from Mosler contradicting the two points I raised.

(3) “and that you lack common courtesy in your replies in such cases”

The comments section of the FM website is a harsh environment. But very few threads have the rudeness and insults of the MMT threads. Those folks are amazing. Prof Dolan was moderating; I never would have tolerated it.

(4) “in so acting you exhibit a degree of intellectual dishonesty.”

Try giving quotes to support your statements, instead of just insults. After 27 thousand comments, I no longer pay attention. Insults usually appear when people run out of logic and facts.

Well, Fabius, I certainly give up. But enjoy yourself. It’s your blog.

Stephen,

“I certainly give up.”

Probably a good thing. As I said, insults usually show someone has given up in the face of facts and logic.

Well Fabius, sometimes the appellation “horse’s ass” sometimes fits to a”t.”

stephen,

Thank you, but you’ve already made my point. No need for you to provide additional evidence.

Your future comments are moderated. Insults will be blocked; actual content will be posted.

Pingback: Studies In Economics » Bastiat’s Idea of the Law » Page: 1 | Studies In Economics