Summary: Today America passed an important fork in the road, an easy exit from the massive monetary stimulus running since the crash. If the economy continues its slow growth (well below the 2% stall speed) today might have been the last opportunity for an easy exit. Today also demonstrated the madness that infects us, as investors cheered the Fed’s bad news about the economy’s slower than expected growth — and bid up asset prices. This post attempts to provide a harsh but accurate perspective on our situation.

See the follow-up post: Different answers to your questions about the momentous Fed decision to delay tapering.

“Damn the torpedoes! Full speed ahead.”

— Paraphrase of Admiral Farragut’s orders at Mobile Bay (1864). A great naval leader; he would have made a terrifyingly bad Central Banker

Contents

- How did we get here

- It was easy. It’s always easy to get hooked

- About government stimulus programs

- About the winners

- Why end the fun?

- Pictures of the US money supply

- For More Information

(1) How did we get here?

The Fed balance sheet has grown from $800 billion before the crash to $3.6 trillion today, now under QE3 increasing at $85 billion per month. While necessary during the recession, this has a side effect, one found in a few other powerful medicines. We have become addicted. I (and many others) warned about this (the original brief version of this post was Dec 2009). Now we’re hooked. Unless we act soon (later this year?) probably much pain lies ahead.

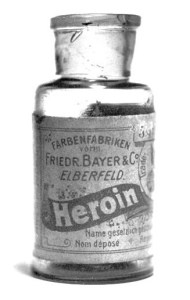

See this excerpt from “Financial Heroin”, Don Coxe, Coxe Advisors, 16 December 2009:

… my father was a doctor in the Canadian Army in WWII, and served in the Italian campaign. He became greatly respected for his anaesthesia and pain management under battlefield surgery and rehabilitation conditions. He was cited after war’s end for perhaps having performed more anaesthetics under such conditions than any other Canadian doctor.

In discussing his experiences, he told me that he swiftly learned that the best — and frequently the only — reliable drug for the critically wounded was heroin. Soldiers who writhed in agony under other medications almost always responded to heroin. The problem wasn’t deciding whether to administer it: if morphine didn’t work fast, you didn’t waste time, you injected heroin.

The problem for the doctor came when the patient had begun to recover from surgery, and was receiving heroin. How quickly could the dosage be reduced and when would it be terminated? Although few soldiers were freed of heroin without experiencing pain and distress, it was necessary to take the drug away as rapidly as possible. Otherwise they would become addicts and their lives would be ruined — for soldiering and everything else.

… Zero interest rates are Financial Heroin.

This goes to the vital points, mostly misunderstood, about the massive fiscal and monetary stimulus governments have applied in response to this global recession. Government stimulus has several characteristics similar to heroin.

- It mitigates the downturn, minimizing the suffering,

- but it does nothing to fix the underlying problems,

- and it creates imbalances which must be removed when the economy recovers.

It’s medicine. Powerful when used correctly. But like all sharp tools it cuts both ways. Confusing first aid (emergency medicine) with long-term treatment can produce serious errors.

(2) It was easy. It’s always easy to get hooked

.

Our leaders are competent and smart. But history is largely a tale of smart people leading nations into trouble. In tough times leaders face harsh choices. Sometimes they take a high-risk path, confident that they can manage it. Sometimes they’re successful. Sometimes the results just feel good for a time.

From “Why Heroin is Better than Everything Else“:

Many people who experiment with heroin are underwhelmed at first (not including IV usage, but few experimenters IV first time). They just feel good, chill, happy, They feel like this spooky drug ‘heroin’ hasn’t delivered. They are mellow. They think obviously it has all been a lie.

Heroin isn’t spooky. It’s not addictive like everyone tells them. It doesn’t make you do stupid s**t or stay up all day and hallucinate like amphetamines or coke. It doesn’t empty your serotonin like MDMA or give you a hangover like alcohol. People tend to think what a nice drug. The next day they wake up and everything is normal. No headache or sh***y feeling. Just a slight afterglow of that nice feeling. … Then next weekend comes … I should get more for the whole weekend. I will use Heroin on the weekends now

(3) About government stimulus programs

The curative properties of government stimulus results from the brief duration of most recessions. They last a year or so, with government programs usually enacted in the middle — near or even after the low, so signs of recovery soon appear. When the private sector has underlying problems so severe they prevent normal recovery — as in the Great Depression, and Japan since 1989 — then stimulus programs are seen in their true light — useful palliatives but not magic bullets.

Unfortunately, measures to mitigate the pain contain a hidden risk, as this down cycle shows. A recession provides a unique opportunity to take important public policy measures, such as tax changes, regulatory reforms, and construction of valuable infrastructure projects. The US has wasted this opportunity, probably because the rapid and strong policy response so muted the pain (or its recognition by our leaders) that insufficient political pressure existed to overcome the inevitable inertia.

What about the beneficiaries of fiscal and monetary policy? We have to pay for fiscal stimulus, and the rich know they’ll get the bill eventually. So they work to end the spending once the crisis fades — far too soon in this cycle, when we could have borrowed cheaply to put many unemployed to work rebuilding America’s infrastructure.

Monetary policy, however, has a different calculus. No politically powerful victims (elderly savers lack sufficient punch). It feels good, and appears to cost nothing. It benefits the nation by boosting the value of their assets. Monetary stimulus is the best public policy.

Users sometimes find they do better work on heroin. Instead of being sad, grumpy or depressed, I am happy. Mellow. Content. I woke up at 5:30AM, it’s raining and dark. I’m commuting in traffic. I would have had a headache, I would have been miserable, I would have wondered how my life took me to this point. But now life is beautiful. The rain drops are just falling and in each one I see the reflection of every persons life around me. Humanity is beautiful. In this still frame shot of traffic on this crowded bus I just found love and peace.

Heroin is a wonder drug. Heroin is better than everything else.

(4) About the winners

Monetary policy works wonders. Not on the economy, after the zero-interest rate policy (ZIRP) has taken effect (see this Fed paper for details). Not for the savers earning a pittance on their nest eggs. it sends asset prices soaring, most importantly stocks and real estate. Like a miracle.Their owners are geniuses. Those using leverage are, entrepreneurs. Those using the most leverage are masters of the universe.

In America assets are mostly owned by the wealthy (the top 10% own 80% of stocks). The industries trading these assets also benefit, also largely owned by the wealthy. They have the political power in America, and use it to keep the monetary juice flowing.

Candidates for high office get vetted on their willingness to continue the monetary juice. Those like Larry Summers, with a combination of sufficient smarts and personal strength to take necessary public policy action that ends the fun, are blackballed. Those like Janet Yellen, smart and proven complaisant, get the red carpet rolled out for them.

(5) Why end the fun?

Heroin builds up a tolerance fast. Heroin starts to cost more money. I need heroin to feel normal. I don’t love anymore. Now I’m sick. …

QE1 was small. QE2 was big. QE3 was “unconventional”. Now we’re hooked, and the rationalizations begin. We are strong. We feel exceptional. We can list reasons that we will dominate the world. There are no ill effects to QE (don’t worry about the mispricing of capital) until either the currency crashes or inflation spikes up — and that will tell us it’s time to stop. And then we’ll stop, rapidly and easily.

Of course most of us see the madness of our policies. But we’re cogs, passive subjects of New America. We saw the madness of the tech boom, and most of us cheered — swept along by the tides of delusion. We saw the real estate boom, but enjoyed our paper profits too much to demand reforms. Now we have the third bubble.

It’s these things that show a people’s mettle. The Constitution refers to “Nature’s God”. She has a balance, and occasionally weighs our worth. Sooner or later we will see the need to take action. The Fed meets in October and December, two more opportunities for hard wisdom. After that we might have action forced upon us by events.

No this isn’t working, I need to quit.

Then will come the difficult days of withdrawal.

(6) Pictures of the US money supply

(a) The Fed’s Balance Sheet, from the St Louis Fed weekly report, QE1 ran from November 2008 to June 2010. QE2 from November 2010 June 2011, QE3 began September 2012.

(b) The Monetary Base

It’s the mirror image, in a sense, of the Fed’s balance sheet: the sum of currency and banks’ deposits held at the Fed.

.

(7) For more information

(a) Reference page with all posts about the Financial crisis – what’s happening? how will this end? – esp section 8, about solutions.

(b) About today’s meeting of the Open Market Committee

- Press Release about their conclusions and actions

- Supporting materials, including their economic forecast

- Also see what’s to come according to the Survey of Professional Forecasters

(c) State of the US economy:

- A look at the state of the US economy. Join me in confusion!, 13 July 2013

- The US economy is slowing. Things might get exciting if this continues., 17 July 2013

(d) Other posts about monetary stimulus:

- A solution to our financial crisis, 25 September 2008 — Among other things, large monetary action

- Important things to know about QE2 (forewarned is forearmed), 21 October 2010

- Bernanke leads us down the hole to wonderland! (more about QE2), 5 November 2010

- The World of Wonders: Monetary Magic applied to cure America’s economic ills, 20 February 2013

- The World of Wonders: Everybody Goes Nuts Together, 21 February 2013

- The greatest monetary experiment, ever, 20 June 2013

(e) About inflation:

- The Fed is not wildly printing money, as yet no hyperinflation, we’re not becoming Zimbabwe, 2 March 2010

- Inflation is coming! Inflation is coming!, 7 February 2011

- Inciting fear of inflation in our minds for political gain (we are easily led), 28 February 2011

- Update on the inflation hysteria, the invisible monster about to devour us!. 15 April 2011

- Explaining the gold standard, the Euro, Default, Deflation, and Hyperinflation, 17 December 2011

(f) About the Fed and money:

- What every American needs to know about the Federal Reserve System, 31 March 2012

- What are the limitations of the Fed’s power? It’s neither impotent nor omnipotent!, 17 February 2012

- The lost history of money, an antidote to the myths, 1 December 2012

.

.

Pingback: Government economic stimulus is powerful medicine. Just as heroin was once used as a powerful medicine. - Global Dissident

ZIRP is a result of desire of PRIVATE sector to save, or not to invest savings, to be more precise.

Natural rate of interest is 0. Why? Because of the nature of banking accounting in capitalism.

Private savings goes into banking reserves. They become basis for 10% requierd reserve for 100% of the loan. ($10 of savings placed in reserve allows for issuing a $100 loan) (That is description of Fractional Reserve Bankning)

As a result of falling wages, capitalist saves more (higher profit), more savings means more availability of reserves for loans-more loans then possible to take by lower buying power of population.

This means that excess savings (which are possible because of stagnating wages over past 30 years) are producing excess bank reserves allowing for excess amount of loans.

Interest rates are controlled by forcing banks to come to the FED for funds to fill the reserves, but when excess savings provide for excess reserves banks do not need to fight for funds and rate goes to 0.

Public debt is emptying banking reserves in order to force them to come for funds, reserves would be replaced by Treasuries which count as public debt.

ZIRP is a result of excess savings and also need for 0 interest rates, so FED just allows IR to come to its natural level. (how much savings is in private corporations? $2T, $3T? this savings is in banking reserves now)

In addition to bank reserves from savings that pushed rate to 0, there are also additional funds from QEx. What QE does?

QE replaces paper assets (DERIVATIVES) with currency which are also placed in bank reserves. And since banks are flushed with reserves anyway, QE does not affect interest rate at all since IR can not go bellow 0 and it got there thanks to excess savings, not from QE. QE reduces price on public borrowing from banking reserves, not other way arround as most of the public thinks and most of the economists.

There is another problem from QE, but it is not that it causes ZIRP, because it does not do that.

Public debt in form of Treasuries is not something to cry about, because it is just a replacement of funds in reserves that would otherwise sit there with paper assets. Tsy’s has to never be reduced since those reserves that were replaced with are requerd to sit there in banking reserves at the FED. Without replacing funds with Tsy’s, which is not necessary, there would be no public debt to look at, to know about. Those funds are requierd to sit in reserves and public debt has need never to be lowered. Level of public debt has to grow since total savings continually grow.

You can look at public debt as putting savings back to productive use into economy.

QE is not stimulus, as it seems that you claim. QE is program for saving banks.

All the paper asset that is supposed to go bust because of underlying value was destroyed was taken on by FED and waits maturity. Those assets are empty,but if banks wait for its maturity, banks would go bust, FED can just let them loose value without ever producing solvency issue that normal banks would experience.

Yes, FED took worthless paper from banks, and paid full face value. That is the damage from QE. Banks are insolvent but still creating same worthless value that will have to be put into FED.

That is the heroin that is saving banks and keeping them placing rent seeking from economy.

But it is not QE per se that is bad, it is the banking industry that is creating finacial instruments of no value because there is TOO MUCH SAVINGS that pushes them to do that.

Using word “stimulus” with monetary policy is a precedent that makes all your post wrong on its head. Stimulus is only with fiscal policy.

Monetary policy can be stimulative, but there is no stimulus as in ammount of money to be tought of as in fiscal stimulus.

Fiscal stimulus from 2009 was used and is there no more. It stoped somtimes in 2011.

If you think of deficit as stimulus, which is correct, then if you remove war and terorist prevention spending there would be no deficit. Or if you employ all unemployed, there would be no deficit.

There is no economic stimulus presently in the US, only automatic stabilisers that are raising deficit spending and defense spending that is extension of precrisis levels. ANd also there is deficit as a result of lower denominator (GDP) not from higher spending.

“Using word “stimulus” with monetary policy is a precedent that makes all your post wrong on its head. Stimulus is only with fiscal policy.”

At least I am in good company. Ben Bernanke makes the same error, frequently referring to “monetary stimulus”. As do his fellow Fed Governors, as does the Fed staff (the Fed’s corps of elite economists). As do economists in general, as their journals are filled with this phrase — and analysis of this non-existent phenomenon.

I will file this advice with all those comments who say that the world’s top climate scientists and major climate science agencies are wrong to refer to the “pause” or “hiatus” in global warming.

So you have 1) 2) and 3) completely wrong but then you switch onto real issue and make 4) and 5) totaly right. 6) has no relation to anything, monetary base has no relation to anything except to gold bugs.

Jordan,

Section two is a quite obvious and broad statement about history, plus a first person account of heroin addiction. Difficult to imagine how either could be “wrong”.

Your statement about #6 shows that not only did you not pay attention to the text, but do not understand what you’re talking about. The monetary base is the near-mirror image of the Fed’s balance sheet — which is the object of quantitative easing (the subject of this post).

I think what the bank deposits at the fed do is make their derivatives business more profitable. In order to make the kinds of massive wagers that the big banks against each other and governments, they need to have a large reserve of cash to pay out at the time when things go bad — and as we know, now, when they go bad, they all go bad at the same time. Having the actual cash to pay off these bets makes them more valuable.

I don’t really see how this affects lending to the real economy so much. I think that’s pretty indirect. Maybe we get a few butler and maid jobs working for rich bankers.

Cathryn,

I agree that the derivative mountain is a possible volcano, and needs far more regulation (but then everybody agrees on that, but only bankers’ votes count).

The derivatives biz and the massive deposits of excess reserves (on which the Fed pays interests) pretty much exist in different spheres.

Your point about servants is IMO very important. Thirty years ago how many people had servants? Three decades of income inequality and our rich live like Mr Darcy at Pemberly, surrounded by people who kiss their feet every morning. No wonder they see themselves as better than us, as did the aristos on ancient regime France.

I’ve used heroin up to 10 times, im not sure about exact number and it was long time ago. Using heroin which was called poor man’s kokain sucks, it is a downer and it is not attractive to use. I believe the addicts on kokain that used up all of their money and have no job are switching to heroin as pure addiction not as if they like it. Heroin sucks, it is not addictive as your post claim, one shot as patient and it has to be cutt off or addiction is there. That is impossible. No addiction comes from one or two or 5 shots, it takes at least 1 month of moderate use.

That was over 10 years ago, now i do not use any drugs, but i know them almost all, by using them. Drug addiction information is replete with propaganda.

“t is not addictive as your post claim, one shot as patient and it has to be cutt off or addiction is there. That is impossible. No addiction comes from one or two or 5 shots, it takes at least 1 month of moderate use.”

Neither of the passages cited says anything remotely like “one shot … addiction is there.” In fact they both say the exact opposite of that.

How would the FED go about draining money out of the system?

By raising interest rates.

Raising interest rates does destroy money, but usual draining money is done by selling Treasuries.

In case of exiting QE, that would be done by selling MBS and other paper assets back to banks.

Smartest way to drain money is by raising taxes on those that have money but that is not in FEDs ability.

Great article, as usual, FM. I strongly agree with all of your comments. But I’ve got a lot of concerns as well.

First, is the economy strong enough to stand on its own without the heroin of QE3. It is hard to know the extent to which our current amazingly anemic recovery is relying on the inflation of asset values (which is the only visible effect of QE3) to show progress. Taking away the punch bowl, or even reducing the quantity of punch in the bowl may have more negative consequences than expected.

The economy just has not picked up enough speed for me to be comfortable with laying off the punch (or heroin to keep our metaphors straight) yet, probably because we didn’t clean up our act sufficiently in 2008. If I were an economic doctor, I’d be arguing that we’d be violating the Hippocratic oath by doing more harm than good to the patient by removing the medication at this stage.

You raise the excellent question of “if not now, when?”

My best response to your question is, “have you considered hospice for the patient?” In other words, we’ve reached the stage where there can be no sustainable recovery and we can only keep the patient comfortable for the time remaining in this world.

Our failure to follow through with sufficient strength on Keynesian stimulus has doomed us to build yet another bubble, the third major bubble in less than 20 years (this has to be some sort of a record). Strictly guessing, I’d say we’ve got another 3-7 years before it pops, the difference between this and recent bubbles is that this one will not pop until it is too big for even the federal government to resolve without causing major damage.

Hopefully we will learn from our mistakes this time.

On a different topic, I’m not a big fan of either Yellen or Summers but would have hated to see Summers lead (or more likely, smash) the Fed. Washington DC is full of extremely smart people who are blinded by their own ego. I tend to be suitably impressed when everybody in DC, left, right, and center, agree that Larry Summers is probably the smartest man in the room but has such a large ego that it continually cripples his performance and blinds him to the consequences of his actions.

The willingness of Team Obama to not only bring up Summers as a candidate in the face of Democratic and Republican resistance but to keep pushing his candidacy in the face of ever-stiffening resistance emphasizes the accuracy of your comments about Obama not being strong enough or far-sighted enough to run the US government at this time.

I suspect that the Obama administration will choose somebody else instead of Yellen as head of the Fed. They got their nose pretty badly bloodied in this last battle and that tends to make people more stubborn, not smarter.

Pluto,

You raise some important issues, too big for comments, some of which I address today’s post.

We use monetary policy because the Right opposes the much more effective fiscal policy. THAT is the great hidden truth today. Obama’s unwillingness — his quiet acquiescence to this — IMO doomed his Presidency. Much like the VietnamWar wrecked what otherwise would have been the stellar LBJ Administration.

As for Summers, it is a hedgehog-fox thing IMO. Summers’ possible willingness to challenge the banks is all that mattered, and doomed his bid.

I guess this was inevitable. It’s more evidence that the addiction model describes expansive monetary policy (i.e., it’s like heroin). It’s disturbing, perhaps scary.

From today’s Macro Strategy Report by Jim Reid (Fixed Income Strategist), Deutsche Bank: