Summary: Have we learned much from our 2008 brush with another depression? Look at the growth in subprime education and auto loans, and decide. Will we reforge the fetters on lenders forged in the New Deal to prevent events like 2008? Failure to learn is one sin that Nature always punishes.

- Borrowing as a driver of growth

- Car loans: sub-prime galore

- College Loans: the new sub-prime

- For More Information

.

(1) Borrowing as a driver of growth

In modern economies borrowing drivers growth. Government borrowing to build infrastructure or even out benefit payments across generations. Business borrowing to fund investments. Households borrowing to buy home or fund consumption.

Such borrowing not only boosts GDP, but creates assets (your debt is the creditor’s asset). Centuries of experience show that this works well when prudently done. Centuries of experience shows the unpleasant results when imprudently done. Loan defaults hurt the debtor, often forcing bankruptcy. Loan defaults convert assets (the loans) into dust — destroying capital of banks and investors (e.g., insurance companies, pension plans).

So the foundation of growth can be sound or fragile. As in 1929, 1999, and 2007. Let’s look at our slow-growth recovery.

Consumer credit growth has accelerated during the past year. Most of this growth is in revolving loans: loans for motor vehicle, mobile homes, education, boats, trailers, and vacations. These loans may be secured or unsecured. Total revolving loans are up 33% from the previous cycle peak in July 2008 (SA), to $2.2 trillion. Most of that growth has been in autos and education loans.

(2) Car loans: subprime galaore

Bloomberg has a disturbing article about auto loans: “Good Job Is Good Enough as Subprime Car Buyers Lift Sales“. Car loans are being made with an average maturity of 62 months and high loan-value levels (80%), so that a high fraction will have no equity if they default. And to make that more likely, lenders are boosting sales by increasing lending to sub-prime buyers.

.

As the fifth anniversary of the Federal Reserve’s policy of keeping interest rates near zero approaches, the market for subprime borrowing is once again becoming frothy, this time in the car business. As with mortgages in 2006 and 2007, the central bank’s stimulus is making it easier for people with spotty credit to buy cars as yield-starved investors purchase riskier bonds linked to auto loans.

While surging light-vehicle sales have been one of the bright spots in the U.S. economy, it’s increasingly being fueled by borrowers with imperfect credit. Such car buyers account for more than 27% of loans for new vehicles, the highest proportion since Experian Automotive started tracking the data in 2007. That compares with 25% last year and 18% in 2009, as lenders pulled back during the recession.

Issuance of bonds linked to subprime auto loans soared to $17.2 billion this year, more than double the amount sold during the same period in 2010, according to Harris Trifon, a debt analyst at Deutsche Bank AG. The market for such debt, which peaked at about $20 billion in 2005 …

“Perhaps more than any other factor, easing credit has been the key to the U.S. auto recovery,” Adam Jonas, a New York-based analyst with Morgan Stanley, wrote in a note to investors last month.

(3) College Loans: the new subprime

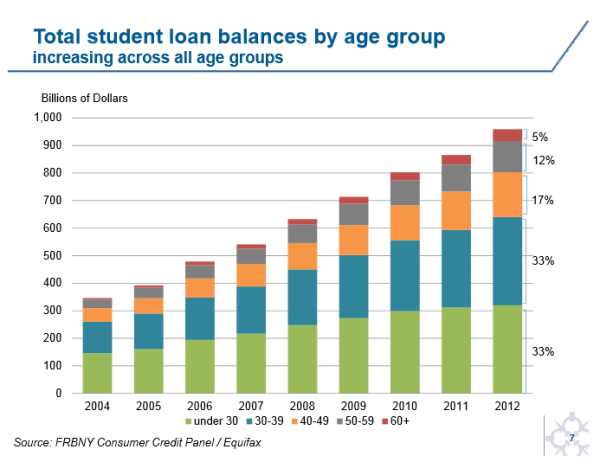

Education loans by the Federal government and Sallie Mae have grown almost 6X since July 2008, to $716 billion. These are, as a group, the new subprime. Default rates are rising. The Department of Education estimates that the default rate over 20 years for loans made in 2009 will be 17%. If economy continues its slow growth since 2008 — plus the falling real median incomes of the past few decades — then those forecasts will prove far too low.

The trends look alarming. The following graphs include both Federal and non-Federal student debt. From “Household Debt and Credit : Student Debt“, Federal Reserve, 28 February 2013 — Part of their quarterly report.

.

.

(4) For more information

(a) About college debt:

- “A Big Default Problem, but How Big?“, New York Times, 8 September 2012

- “Are U.S. Student Loans the ‘Next Bubble’?“, master thesis of Omar Abdel Rahman, Swiss Federal Institute of Technology, 1 April 2013

- Default Rates Continue to Rise for Federal Student Loans, September 30, 2013

(b) Other posts about college education:

- What should a student learn from college? Why go to college?, 1 November 2009

- College education in America, another broken business model, 3 July 2009

- The secret about our universities (seldom even whispered among Professors), 5 July 2009

- Women dominating the ranks of college graduates – What’s the effect on America?, 7 July 2009

- A better answer to “why women outperform men in college?”, 8 July 2009

- Is a college education worth a million dollars?, 10 July 2009

.

.

Pingback: Rising consumer debt: boon or bane? - Global Dissident

One of the possible factors in the college loan problem is the potential that the poor job market plus the incentive to avoid the negative consequences of loan default will drive even more students to choose fields of study which are (somewhat naively) considered tickets to a highly lucrative career — law, finance, business, marketing, political science, etc. — which will facilitate easy repayment of their student loans as well as open the door to a lifestyle of conspicuous and often wasteful material consumption (a cultural more which actually hasn’t diminished all that much despite five-plus years of worrying economic results).

What they fail to realize is that in a job market such as we have now, this becomes something of a sucker’s game. Even at the best of times, when there’s a glut of candidates for a profession, the profession turns into a game of musical chairs — when the music stops, someone will be left without a seat. In the current state of affairs which are by no means the best of times, a significant number of someones are without seats, many compelled to accept less (frequently far less) lucrative employment — and increasingly, employment for which a college degree is often superfluous. (This is why some people over the past few years have actually begun asking whether a college degree should still be considered a worthwhile and profitable investment — which is something of an irony, considering that a college degree has never been within reach of more than 50% of Americans to begin with). This is even before we address the fact that education is increasingly seen as solely a means to an end instead of an end in itself — a way of obtaining a better job or career instead of as a way of expanding and improving the minds of those who attend for the benefit of both the individual and society at large (which was the original purpose and function of a college education). This may be the reason why some segments of society (i.e., evangelical Christians and the neoconservatives) are critical of college and those who are employed there…because its ostensible purpose is to expand the mind and open it to alternative ideas.

What they also fail to realize is that not only do largely administrative careers such as those outlined above not contain the means to stimulate the economy to the degree that we need — certainly not in comparison with those in fields such as engineering would be more likely to do (since bureaucracy is the only way for administration to generate more meaningful growth than manufacturing) — but as FM points out, we are at risk of creating a self-sustaining trend in which the colleges simply churn out students whose degrees are actually not relevant to either the specific or overall needs of the market (even though college is still overwhelmingly seen as the best if not the only reliable path to a high income) and therefore of little actual worth, compelling their children to apply for student loans because their parents cannot afford the rising cost of college. At the same time (as I discussed in a comment on an recent post), it also increases the risk of creating a self-sustaining class-based educational system in which only the wealthy are able to afford higher education and obtain good jobs — in part because unfortunately, obtaining a good job is already a function of who you know as much as what you know.

And then we wonder why some people increasingly see this country as a sinking ship with no cargo to throw overboard?

Bluestocking,

“What they fail to realize is that in a job market such as we have now, this becomes something of a sucker’s game.”

(1) see Law. (My guess is programmers might follow this pattern). For profit, law schools gave grossly overproduced attorneys. Now with attorney unemployment high and incomes low — and student debt sky high — law school attendance is crashing ( or perhaps starting to crash).

This boom-bust cycle might become common in the college-educated trades where there is no cartel limiting production of degrees (e.g., MD’s).

For more about this see Paul Campos articles at Lawyers, Guns, Money (Prof of Law, U CO-Boulder):

http://www.lawyersgunsmoneyblog.com/author/paul-campos

(2). It will get worse for the professions as automation hits them. For many, much worse. The current structure requires students with advanced degrees to graduate with large debt OR after periods of low wage servitude. Falling wages and unemployment will hit them very hard.

FM, I’d be curious to know your thoughts regarding The Zeitgeist Movement — an international activist group which is attempting to alert and educate people about the increasing robot revolution and at the same time promote an alternative resource-based model which aspires to facilitate the transition into a future where human labor will become increasingly obsolete and eliminate any reason as well as any need to work for wages.

Speaking as an idealist — albeit an extremely disillusioned one (which is why I sometimes describe myself as a cynic) — as well as something of a futurist by nature, I’m sympathetic to The Zeitgeist Movement even though I’m also distinctly skeptical of their actual ability to achieve their aims. This is not because of any particular lack of reasoning or effort on their part — far from it — but rather the apparent lack of reasoning and motivation as well as significant creativity among the target audience (i.e., human beings in general and Americans in particular). I’ve watched most of the video presentations which they’ve put together — many of which are available for free on the internet at such sites as YouTube and The Internet Archive — and highly recommend the films in the recent “Culture In Decline” series. The fact that Peter Joseph — the ostensible spokesperson of the Zeitgeist Movement — makes many of the same sort of points in his videos that you make here on this site leads me to think that you might have some sympathies with them yourself (at least in theory if not necesarily in practice).

As I said, i have my doubts regarding whether the aspirations of the Zeitgeist Movement are feasible — in part because they seem to be rather conveniently denying, ignoring, or overlooking the fact that there’s no such thing as a perfect system (especially not in an open system such as human culture where there’s such a wide variety of unpredictable potential variables). As I’ve reminded members of Zeitgeist from time to time, nature abhors a vacuum and theory is the only place in which theory translates flawlessly into pratice. Nevertheless, as is the case with this website, I think the effort being put forth is worthwhile and necessary even though it is on many fronts an uphill battle.

Bluestocking,

I have not heard of Zeitgeist Movement.

However, I believe these are secondary questions to the political one : citizens or subjects? If the former, we need technical fixes. If the latter, technical fixes are in vain.

The great oddity IMO is why this is not obvious. I look at most of the successful predictions made here and wonder why they were so controversial (as seen in the comments here, and in the critical responses to others who also saw these things):

http://fabiusmaximus.com/about/predictions/

I wonder the same thing about my current predictions — such as the high odds of a bad ending of the great monetary experiment. I must be overlooking some structural factor.

“Citizens or subjects?”

A vital question indeed…one which The Zeitgeist Movement is also encouraging people to ask both of themselves and society as a whole (and I can assure you that their answer to this question is most emphatically in the “Citizens” column, which is probably one of the reasons why they’re in favor of technological fixes). If you’re not familiar with The Zeitgeist Movement, I’d encourage you to watch some of the video presentations they’ve made available to the public…as I said, they seem to be raising some of the same questions and making an effort to address some of the very same issues which you discuss on this site. Like you, they don’t support either political party and very critical of the current political process — if anything, their stance is that politics is increasingly being used by the Powers That Be (regardless of party) as a means of keeping the ‘bewildered herd” distracted and oblivious and passively compliant — Divide And Conquer.

IMO, one reason why this is not obvious to more people is because human beings are to all appearances very much creatures of habit who are (sometimes extremely) resistant to change. As the old proverb states, “better the devil you know than the devil you don’t.” The “Greatest Generation”, the last generation of people in this country who experienced and understood true deprivation and sacrifice as a nation and on behalf of the nation rather than as individuals (the ones who lived through the Depression and fought in WWII), is disappearing — they are either already dead or death is not far off. Once they are gone, there will be no one left in this country who can remember it when it was made up mostly of “have-nots” and very few “haves” (although we’ve almost imperceptibly yet steadily been moving back in that direction over the past few decades). The Baby Boomers were born and raised during a period of tremendous success in this country…but to paraphrase a quote I recently came across, “success breeds complacency and complacency breeds defeat.” As a nation, we appear to have become so accustomed to and so convinced of our own success (even when illusory) that we perceive ourselves as invincible. This is what’s come to be called Victory Disease…and it usually ends in disaster.

I very much doubt that there’s any one structural factor you’re overlooking, FM…if anything, I think there are so many structural factors currently in crisis connected to each other in this equation that it’s hard to know where to start. For me, it’s looking more and more like the guy in the variety show who spins plates on poles…he’s always running around trying to stop this plate or that plate from falling down.

Dr. Noelle Turner, -$213,000 student loan debt — “If I die, send my death certificate to this company.” “Do not get a degree in the social sciences.”

This is how it goes, a little bit of youthful indiscretion and over optimism, and then a lifetime of debt enslavement. Student loans are destroying lives. People are not having children because of this. Search on youtube, you’ll find the stories.

http://www.youtube.com/watch?v=AiCg92uKN5g

http://www.youtube.com/results?search_query=i%20majored%20in%20debt&sm=3

Car loans, well, I don’t know. If you lose your job, then the repo man takes it away, ruins your credit rating — but what does that matter these days? Thanks to the legacy of ‘National City Lines’ this country is layed out so you need a car to get to work, to do anything — so it’s difficult to avoid getting a car. The main thing is not to get greedy and buy more car than you can afford.

Cathryn,

” The main thing is not to get greedy and buy more car than you can afford.”

Fortunately we do not put drug pushers in pharmacies, so that each time you go to buy cough syrup you must resist high pressure tactics to buy codeine, or buying aspirin they push you to buy heroin.

But that is the car biz.

We have structured our society to increase vulnerability of not-smart and weak people to serious exploitation.

Then we wonder why it does not work so well.

“The main thing is not to get greedy and buy more car than you can afford.” — Carolyn Matagna

That’s very important, yes, but I wouldn’t say it’s the main thing. Personally, I’d say that the main thing for most people (that is, anyone who’s not indepedently wealthy) is to view the car the way my parents did theirs…as merely a useful and important appliance rather than as an extension of their egos (and which is therefore prone to always be looking for something bigger and better). Our culture has become so incredibly superficial and elitist that it encourages even the poorest among us to calculate other people’s worth (and our own) almost entirely on the minutiae of just about anything and everything we do — what we own, what we wear, what we drive, what we eat, what we watch, etc. — instead of on the basis of who we are (are you kind, are you honest, are you ethical, etc.). I’ve made the point in the past that part of what has been driving the growth of this culture over the past three or four decades is what I call the worship of wealth — no matter how that wealth is obtained. It’s penetrated our society to such a pervasive degree that consumer debt — something which used to be considered a serious moral failing in times gone by! — is now so commonplace due to so many people aspiring to a lifestyle beyond their means that it’s actually fairly unusual to find anyone outside the 1% who isn’t in debt (and we’re so completely hooked on this as a nation that even some of the 1% have debt because the culture tells us there’s no such thing as enough).

Granted, this has always been true to some extent — even Laura Ingalls Wilder (of the “Little House” series) described being the target of snobbery from children who lived in town because she lived in the country. However, there was a time when this was less likely to be true of most adults (apart from the wealthy who could afford to concern themselves with fashion). Granted, this was partly because the people of that time didn’t live in a disposable society (people had much less and therefore took more care of what they had) and partly because people were too busy trying to get by to be bothered with such things…but it was at least in part also because the culture in general also appeared to value and respect virtuous behavior more than it does today. (The reports regarding such things as the prevalence of academic cheating and the attitudes that drive it help support this theory.) Personally, one of the things which I consider staggering about the Information Age of social networking is the fact that this does not appear to be making nearly as much of a difference when it comes to personal reputations (either public or private) as one might have expected — and one conclusion that must be drawn from this is the possibility that character is really no longer considered an important or valuable quantity in this society (at least, certainly not in comparison with image). Call me a cynic if you must — as I’ve said, I readily acknowledge that the shoe (or stocking) fits to some extent — but that’s how it appears to me.

In the Auto loan arena, one of the little talked about aspects is “upside down trades”. This happens when the value of the trade in is less then the payoff on the loan. So in order to get the deal done, the shortage is rolled into the new loan unless the buyer has cash to fund the difference. The method of accomplishing this is to boost the selling price and the trade-in value.

As a result the Loan to Value ratio often exceeds 100%. The lender has more risk because the value of the collateral is overstated. These loans may be made to folks with good credit, but they are really subprime, too. These loans will be upside down even longer than normal, And they are so far upside down that these folks are effectively out of the market for most of the loan period.

This does not bode well for this segment of the industry and probably has negative consequences for other industries as well, as the overall creditworthiness of the consumers is reduced.

Doug,

Good point.

The increase in both length of loan and loan-value ratio makes an increasing fraction of cars have negative equity. Then rolling that into the NEXT car leaves people vulnerable to repossession.

This is probably one reason for the average age of cars increasing — low car equity, rising car prices, and stagnant incomes offsets the lower interest rates.

The other side is that normalizing rates might trash the auto market (perhaps housing also), as low rates mask the collapse of fundamentals.

FM – “This is probably one reason for the average age of cars increasing”

Agreed. I played that game for a little while a long time ago and it was nasty. Fortunately I wised up and got out before everybody else got into it, I hate to imagine what it must be like now that so many people are involved.

Another reason the average age of cars is increasing (and this is a positive) is that the vehicles are able to last longer. I live in a high rust state and I used to be lucky if I kept a car to 10 years old without having the doors or floorboards rusting out.

Right now my oldest vehicle is 9 years old and doesn’t have a speck of rust on it. This is good because I won’t be able to afford another car for at least another 4 years. Now if the engine will only last as long as the body I’ve be okay…

My take on the lengthening of loan terms and rolling negative equity into the next loan, is that the car dealers, auto manufacturers, and lenders are all defecating in their own water supply. Pretty soon they will have no one left with the capacity to pay and the industry will be back where it was in 2008. All this to get the sales now rather than 6 months from now.

doug,

“All this to get the sales now rather than 6 months from now.”

The very essence of American business today.

I wonder… as with health care, do most developed nations that are not the United States have a more sane and equitable way of financing education?

Coises,

Yes.

This is why tax burdens and incomes cannot be easily compared across nations. We pay less in taxes than many of our peers, but get far less in return — as much of what we pay goes to the 1%, and we pay so much more than our peers for basic services like health care and education.

(please correct any errors or omissions in the following)

4 year degree completion has just pushed past 30% in the last several years in the usa:

http://en.wikipedia.org/wiki/Educational_attainment_in_the_United_States

“corporatized” educational bureaucracy, including fundraising, marketing and compliance, has displaced teaching, learning and scholarly/research activities. there is a large body of analysis and complaint about the problem in the Chronicle of Higher Education, the academic blogosphere, etc.

a toxic pattern has become widespread: vast, bloated, top-down administrative empires have been created around the construction of entertainment and sports complexes at most colleges and universities. corrupt bank and finance schemes are probably involved. the herd mentality prevails.

A recent rant by a disgruntled univ. of new mexico computer science researcher who decamped and went to work for google is epic.

there was a landmark SCOTUS case about 12 or 15 years ago in which tenured faculty were presented with a choice: 1) fight for academic freedom and democratic governance, or 2) have job security. guess what the choice was? answer: abandon principle, and keep the money.

that was seen as a giant green light by the corporatizers to take over and marginalize critics, dissidents and non-conformists. political correctness became a tool to attack critics and enforce conformity.

complexity leads to dysfunction, which causes internal rot in organizational culture. this is furthered by vast, costly technological quick fixes, or fizzes as the case may be.

there is very little incentive to be efficient or innovative. this is presumably similar to FM’s frequent critique of “careerist” rot in the military bureaucracy, which has similar elements: contractor revolving doors, procurement corruption, dysfunctional interaction with policy makers, manipulation of public opinion in counterproductive ways, etc.

the college ratings publications are a particularly pernicious element of the system of rot that has developed.

and, the very nature of knowledge creation and dissemination has been significantly altered by postmodern culture’s tendency to abandon the canon for feel good fluff and politically correct thought policing.

I think it’s a huge problem that so many young adults today choose to embark on courses of study that are largely irrelevant to the actual job market, and choose to take on debts that are largely inappropriate to their future earnings, largely because they haven’t seen a realistic picture of the labor market, or of what those large dollar figures actually mean later in life.

This topic is very close to me, because I’m a member of this demographic and I see the unfortunate results all the time around me.

I’m convinced that this disconnect between expectations and reality for young adults today, and the misallocation of resources it causes, is one of the defining conditions of our time, although the effects won’t be entirely realized for years to come.

I hear a lot of stories about, say an Ethnic Studies major who is genuinely surprised when they learn there is no clear career track for her skillset, or an Economics major who thinks he knows everything about money and employment up until he tries to apply for a job, or an Art student with a huge portfolio of works that no one but her teacher will ever actually see. These people realize only after they’ve spent 4-5 years of their life, perhaps $50K – $100K, and a lot of personal grief, that it all wasn’t worth much more than a single line on their resume. Upon this stark realization, they end up either reevaluating their priorities and then settling for a job that does not require a college degree but at least pays the bills, or they choose to defer reality by taking on even more debt and going back to school for an even more advanced degree. Of course these people are not stupid, just misinformed and ignorant of the realities of the world until after they’ve already sunk considerable costs into a dead end.

I really don’t like to think what will happen in the US when my generation becomes the dominant demographic group. I’m imagining approximately 75 million people, many of whom will have delayed or no career, delayed or no professional skill acquisition, delayed or no family creation, and very-low-to-negative net savings. These people who will also have to support the retired Baby Boomers, either personally or through SSI, whose own savings are not quite adequate either, and whose medical costs are already 11% of GDP today, and I think likely to balloon over the next couple decades as they age. This is all at the same time as greater population and resource pressures, greater international competition, and a deteriorating stock of public infrastructure.

Anyway, I strongly feel that this issue deserves more attention. Thanks to Fabius Maximus for bringing it up.

Education as Welfare for the Rich and Poor, Educational Merit Not Considered

President Obama’s education policy being directed toward college in general and two-year colleges in particular. Term two has correctly brought the word vocation into play!