Summary: Understanding events requires not just see what’s happening today and guessing about the future, but also grading past expectations vs the actuals. Otherwise we live in the now, like cats, with little ability to shape our world. This is one way, perhaps the best way, to evaluate experts in fields other than our own. Doing so takes us from the warmth of their confident words, and opens us to see surprises, valuable since experts seldom confess to them. Today we’ll examine the big macroeconomic surprise in 2013, and its warning.

“Perchance he for whom this bell tolls may be so ill, as that he knows not it tolls for him; and perchance I may think myself so much better than I am, as that they who are about me, and see my state, may have caused it to toll for me, and I know not that.”

— John Donne (1572-1631), Devotions Upon Emergent Occasions

Contents

- The big macroeconomic surprise of 2013

- The ECRI points to Japan

- Larry Summers points to Japan

- Other economists speak up

- For More Information

(1) The big macroeconomic surprise of 2013: falling inflation

This graph of US inflation tells an interesting story. In 2011, as inflation rose, conservatives prepared themselves for the I-told-you-so rapture of dollar collapse and hyperinflation (this was the opening salvo, on 11/15/10). Niall Ferguson cleared a space on his mantel for a Nobel. But inflation peaked in January 2012, entering a steep decline. In the 4th quarter of 2012 everybody expected that the Fed adding a trillion dollars to its balance sheet would change that. So far it has made little difference.

This is Core Personal Consumption Expenditure Index, which provides one of the best available measures of inflation and its momentum.

.

This is a shocking surprise. The Fed began the third round of quantitative easing (QE), a form of unconventional monetary policy, in September 2012 at $40B/month, and boosted it to $85B in December. Here’s what economists expected to see in 2013, as measured by the Core Personal Consumption Expenditure Index:

- Fed Survey of Professional Forecasters as of November 2012: 1.9%

- Fed forecast as of their meeting on 12 December 2012: 1.6% – 1.9%

After a year of QE, the Fed pumping out a trillion dollars, economists have lowered their forecasts for inflation. We live in a world of wonders.

- Fed Survey of Professional Forecasters as of August 2013: 1.3%

- Fed forecast as of their meeting on 18 September 2013: 1.2% – 1.3%

Take a moment to absorb this. For five years inflation has been below the Fed’s 2% floor, despite three rounds of QE. That’s bad. They set a floor for a good reason: deflation is lethal for a high-debt economy like ours. A steady 2% inflation does little or no harm (despite giving conservatives reason to whine about the 20th century’s drop in the US dollar (during which time the US became the world’s superpower). A 2% floor gives the Fed a cushion of time to act when it’s breached, and time for their actions to have effect.

What insights can we draw from this? Opinions differ. There is one theory, obvious for several years but seldom mentioned (too scary): we now follow Japan down a path of slow growth and deflationary tendencies. In June 2010, during the euphoria about our “V” shaped recovery, I wrote about it: We are following Japan’s path of decline. The real test comes later this year.

After three years of slow growth despite intense stimulus, now a few bold economists warn us of this danger.

(2) The Economic Cycle Research Institute points to Japan

“Becoming Japan – part 2“, ECRI, 4 November 2013:

.

Earlier this year we pointed out that, with the U.S. and other major Western economies experiencing slower growth in the last five years than Japan in its lost decades, long-term trend growth had already downshifted around the world, resulting in weaker recoveries and more frequent recessions than most had expected when the 21st century began. Following Japan’s lost-decades example, the policy response has been more and more quantitative easing, which has been unable to break this pattern.

Rather, in the U.S. and the Eurozone, the central banks are increasingly failing to meet critical inflation target mandates. In reality, these major economies are already like Japan in its lost decades, recalling the economic truism that recession kills inflation.

Indeed, harmonized CPI inflation fell to just 0.7% in the Eurozone in October. But in the U.S. it had already fallen to 0.8% by September, when inflation in both economies dropped below that in Japan.

Ominously, ECRI’s Future Inflation Gauges remain in cyclical downturns in both the U.S. and the Eurozone. Thus, in the coming months, inflation is likely to fall further below their official targets in both economies.

For more about this see the ECRI’s “Becoming Japan – part 1” (30 July 2013).

(3) Larry Summers points to Japan

“Larry Summers just confirmed that he is still a heavyweight on economic policy“, Miles Kimball (Prof Economics, U MI), Quartz, 15 November 2013 — Excerpt:

After his praise of Fischer, Summers gives a conventional account of the financial crisis in the fall of 2008 and the largely successful efforts to contain that crisis. But the rest of his speech goes in surprising directions.

Summers emphasizes the possibility of “secular stagnation” like that the Japanese economy has suffered in the last two decades. The extent of Japan’s stagnation is breathtaking: In 2013, the Japanese economy is only half the size economists in the 1990’s predicted it would be by now. Even here in the US, GDP is falling further and further behind what we would have predicted just a few years back, and the fraction of the population that has a job has hardly recovered at all in the past four years, despite the fact that the financial crisis was well-contained by November 2009.

What lies behind the stagnation the Japanese economy has suffered in the last two decades and that Summers fears for the United States? What can we do about it? Read the rest of the article at Quartz, or watch his speech:

.

.

(4) Other Economists Speak Up

Summers legitimized this question. Now other economists speak up.

- “A Permanent Slump?“, Paul Krugman, op-ed in the New York Times, 17 November 2013

- “Secular stagnation: The solution that cannot be named“, Ryan Avent (journalist), The Economist, 17 November 2013

- “Focus on NGDP expectations, not interest rates“, Scott Sumner (Prof Economics, Bentley U), The Money Illusion, 17 November 2013

- “Are real rates of return negative? Is the “natural” real rate of return negative?“, Tyler Cowen (Prof Economics, George Mason U), Marginal Revolution, 18 November 2013

- Brad DeLong (Prof Economics, Berkeley) comments at the Washington Center for Equitable Growth, 18 November 2013

(5) For More Information

(a) Posts about Japan:

- We are following Japan’s path of decline. The real test comes later this year., 23 June 2009

- As Japan sails into the shadows, let’s wish them well and wave good-by, 14 July 2009

- Japan can again become the land of the rising sun. We should watch and learn from them., 1 November 2012

(b) Posts about inflation:

- Inflation is coming! Or so we’re told. Instead look at the evidence., 7 February 2011

- Inciting fear of inflation in our minds for political gain (we are easily led), 28 February 2011

- Update on the inflation hysteria, the invisible monster about to devour us!. 15 April 2011

- Conservatives were correct: we have record-breaking inflation! What’s next?, 14 June 2013 — Record low inflation

- Lessons from the failed forecasts of inflation since the crash, 5 October 2013

.

.

Pingback: Are we following Japan into an era of slow growth, even stagnation? - Global Dissident

Paul Krugman’s Sunday column also addresses this: A Permanent Slump?

Coises,

I see many economists have spoken up about this in the last 2 days. I’ve added a section with links to some of the most interesting.

For several years economists have told me this comparison is silly. Now Larry Sumners talk about it, and it becomes a legitimate subject for discussion.

This is how science works, not much like the comic book version promulgated by people who use science for political purposes. It’s a social process.

No, worse. Japan had several things that, sort of, protected (well alleviated) it through it’s long depression.

There are other reasons of course but mainly because of the above they have maintained reasonable standards of living despite the ineptness of their Govt which encouraged the property.financial/etc boom, crushed by the inevitable collapse, followed by the totally disasterous attempts to protect the beneficiaries of that ‘ponzi’ boom that doomed the country to, basically, an endless depression.

Neither the US or the UK are in that position. The US has the position, for now, of being the ‘reserve currency’, therefore they can print their way and deregulate their way to protecting the wealth of the beneficiaries of their serial ‘booms’, albeit at the cost of the rest of the population.

None are sustainable. In Japan’s case, despite decades long effort their (mostly) financial elite organisations are still laboring under the losses made from the days when the property value of Tokyo (alone) was valued at more than the entire US. Their internal savings have, largely been used up and wasted and they are starting to need external money. Compounded by their export industries have been struggling to compete against the giants like Germany and China.

In the US’s case, everything depends on its dollar being the reserve currency, that is ending so fast it is not funny these days. When that ends, then their real civil war starts. As easy money and profits dry up for its elites, then they will have to accelerate their looting of the broad population further impoverishing the, rapidly already being impoverished, population.

Though for large numbers of Americans, who have already lost everything, their jobs, their houses and their pensions that is moot, it might (just might) motivate those who still have something for the moment, to fight back.

And, given the FM team’s background and interests, seeing the heads of the US’s military forces (inc the Marines) telling Congress recently that the wages and benefits of soldiers have to be cut .. that civil war is going to be very interesting….

Oldskeptic,

(1) Thanks for the comparison to the UK. I’ve written about the perilous stated of their economy, and forget to add that to this post.

(2) I don’t understand much of this comment, however. Can you provide some citations for these things?

(3) “seeing the heads of the US’s military forces (inc the Marines) telling Congress recently that the wages and benefits of soldiers have to be cut — that civil war is going to be very interesting”

That seems over the top. The military is doing what corporations have been doing for a generation: downsizing their workforce, and using that as an opportunity to cut wages. Done slowly and incrementally it doesn’t alarm the sheep.

If I had a dollar for every liberal who predicted a “revolution” or “civl war”, I’d be a very rich man. In fact civil wars and revolutions are rare events. They loom large in our imaginations because they shine so brightly on the pages of history, while the more common generations of quiet oppression remain unnoticed.

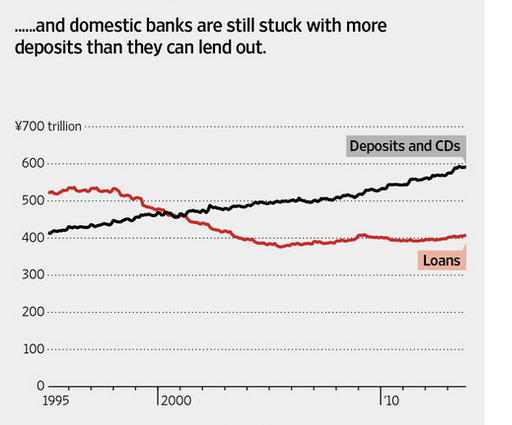

About Japan’s banks

Japan’s banks have recapitalized during the past quarter-century. Bad loans have been written-off, and decades of slow loan growth have left them overcapitalized. There is no one definitive metric for bank solvency and financial strength, but the Loan-Deposit ratio has one of the highest predictive performance. Japan’s banks are ready to rock and roll, should their loan growth ever resume.

From the Wall Street Journal, 18 November 2013:

.

[caption id="attachment_58619" align="aligncenter" width="461"] Wall Street Journal, 18 November 2011[/caption]

Wall Street Journal, 18 November 2011[/caption]

“And, given the FM team’s background and interests, seeing the heads of the US’s military forces (inc the Marines) telling Congress recently that the wages and benefits of soldiers have to be cut .. that civil war is going to be very interesting…”

I’ve been saying for a while now that if the time should ever come when the American people are compelled to protect themselves from their own government — regardless of whether the people act defensively or pre-emptively — one of the most critical factors which will determine success or failure may very well be whether or not we have the military on our side.(especially in the shape of the rank and file soldiers).

The defense industry is no longer exclusively marketing its products to the military, but is now seeling them to police departments around the country as well. You might well be inclined to ask yourself “why would a police department need a tank?” — but this doesn’t change the fact that a growing number of police departments around the country have begn purchasing tanks and other kinds of heavy-duty armaments. Of course, what this means is that American people are not only overwhelmingly outgunned by the federal government (as represented by the military) but increasingly outgunned even by state governments as well (as represented by the police). The NRA can natter on about the Second Amendment all it wants to, but all their posturing and grandstanding doesn’t change the fact that a war between the American government and its people will almost certainly result in an extremely high civilian casualty rate…especially since the vast majority of Americans are not trained to fight.

The only advantage which the American people definitely have on their side at this point is that of force of numbers…but one possibility which might shift the balance more in our favor would be refusal on the part of people in uniform to move against their own people. The fact that many of the rank and file come from low-income families themselves might actually be an advantage in this regard — and especially if they have reasons to feel that the government has not been treating them fairly.

Bluestocking,

My reply: I believe that you, like Oldskeptic, are grossly exaggerating the proposed cuts in military compensation. Military comp has to be revised, because the value of the early retirement (after 20 years) has become too large — and shortchanges the compensation for the majority of uniformed personnel who do not serve 20 years. It’s a daft structure. This necessary restructuring will be, as I mentioned below, accompanied by equally necessary reductions in the workforce (resizing for a peacetime military) AND cutting compensation (SOP for American industry for over a generation).

There is no basis for assuming the drastic effects that you and Oldskeptic project.

There is a more interesting aspect to this. There is no reason for surprise at this policy. The policy assembly line in America starts with right-wing thinktanks and ends with implementation. As with ObamaCare, with its roots in proposals by the Heritage Foundation in the 1990s. In fact, Heritage was one of the first calling for “reform” (i.e., cuts) to military compensation. Readers of the FM website saw Heritage’s first salvo reported here in June 2010.

Americans are surprised so often by events because we rely on the news media, which keeps us stupid. There are alternative sources, because the truth is out there.

I’m still waiting for the *really* unconventional monetary policy.

I assumed Bernanke was serious about the helicopters, although maybe not in a literal sense.

If inflation is falling below targets, and GDP growth is falling below projections, and the Fed does indeed want to turn that around, then what about simply giving a thousand dollar check to everybody with a social security number? What about ten thousand? I think that would inflate things pretty well.

I have also been waiting with open arms for the helicopters. So far no luck.

My best guess as to why is that the central bankers are still very much afraid of inflationary pressures and so prefer to attempt to encourage demand growth indirectly via QE and other mechanisms.

Based on the last 3 years of observation, the indirect method is not going to succeed by itself. But I have no greater wisdom than the central bankers as I also fear inflation if/when the economy finally starts moving again.

The reason is that the CB can not do helicopter drops. That would increase the NFA (net financial assets) of the private sector and only congress can do that.

That why I was always puzzled about this idea that the CB was printing money and flooding the economy with cash nonsense. The CB can do QE to infinity but it all nets to zero change in private sector NFA. If you had 1 trillion in NFA before QE you would still only have 1 trillion after QE.

Only congress can perform fiscal operations.

Re: Net financial assets

I believe DAB uses this in a way other than the standard definition of “financial assets – financial liabilities”. Many of these concepts are seen differently using Modern Monetary Theory (MMT). Here’s one definition widely cited.

Todd,

That’s an interesting question, and timely too — there have been calls to do exactly that.

However, public policy actions are constrained by people’s perceptions of what’s right. Their perceptions — normative limits — might be irrational from other perspectives (e.g., look at limitations on actions of Medieval monarchs), but are binding nonetheless.

The easy and effective method of rapidly distributing money is — as Keynes prescribed — fiscal policy. The government borrows at low rates to build useful infrastructure, and do other useful things.

It is IMO the most signs of our political dysfunctionality that conservatives have so successfully fought the obvious remedy to this slowdown — forcing the Fed to resort to these monetary games of dubious effectiveness and potentially great risk.

I and so many others have said this since 2010, to no effect. Voices in the wilderness.

My inclination is to view with suspicion any “one-shot” fix to what appears to be a persistent systemic problem; and to be wary of unconventional fixes when we do not yet understand the root cause of the problem. (Keynesian fiscal policy is neither one-shot nor—when exercised within reasonable limits—unconventional.)

Summers, et. al., have reached the point where they are ready to accept the possibility of a persistent problem. The suggestions offered so far, though, strike me like saying, Untreated, the patient is running a fever of 104. However, if he remains in an ice water bath for the indefinite future, we believe we can hold that down to 101.

Think for a moment about what negative real interest rates means—in real terms, for ordinary people. That seems to be the proposed “solution” to an economy dependent on bubbles and unsustainable debt.

We’re not going to make real progress until somebody figures out the equivalent of There is a nail in the patient’s foot. We need to remove it so he can heal, and then treat the infection so it abates more rapidly.

Coises,

“However, if he remains in an ice water bath for the indefinite future, we believe we can hold that down to 101.”

Not exactly.

There is no transcript yet of Summers’ speech, and I have not listened to the video. So this is a tentative statement — but it seems to me that he is saying that there is a monetary solution for the US economy, and that US monetary policy should be looser.

I disagree with the first, and suspect the latter is mad. More about this in a future post.

Transcript of Larry Summers speech at the IMF Economic Forum, Nov. 8, 2013

Sorry to make this a Facebook note (and hence inaccessible to those who don’t use Facebook), but if it should get a lot of traffic (being that lots of people are talking about it, but there are no known transcripts yet), my little personal web site wouldn’t handle it well. Fabius, please feel free to copy the text to this site and link to it instead, if you are comfortable doing that.

Coises,

Thank you very much for this!

Summers doesn’t really assert that there is a monetary solution; aside from a passing reference to deficits and one mention of “doing less with fiscal policy than has been done before,” he just doesn’t consider anything else.

By omission, he implies that whatever does not have a monetary solution, we simply must learn to live with.

And I’m pretty sure that was a smile on his face as he explained, “And most of what would be done under the auspices — if this view is at all correct — would be done under the aegis of preventing a future crisis would be counterproductive, because it would in one way or other raise the cost of financial intermediation, and therefore operate to lower the equilibrium interest rate that was necessary.”

Still delighted to tell us how we must not interfere with the free reign of the masters of the universe.

Join the degrowth movement. Read about the Barcelona Conference (2010). Growth is a fraud upon the working class.

Oldskeptic claims:

Do you have any evidence to back this up? The rest of the world’s economies are in far worse shape than America’s. China’s growth is slowly, their elites are staggeringly corrupt to an extent that makes American scandals like the recent settlement for robosigning fraud look like a parking ticket by comparison, the Chinese economy is a black box with no transparency, and their workforce is now under severe pressure as the Chinese government finds it increasingly hard to follow through on promises to trade off prosperity for lack of civil rights.

What other country would you suggest as the global reserve currency? China? Europe’s Euro? The Saudi riyal? Brazil? Japan?

None of these countries provide the combination of sheer global economic heft, economic resiliency, transparency, accountability, objective and reliable civil courts in case there are problems with your investment, military reach, and global cultural “soft power” we find backing up the American dollar.

In fact, contrary to Oldskeptic’s assertion, since 2009 the evidence shows clearly that the position of the dollar as global reserve currency has become more secure, not less. Just look at the astounding appetite for America’s negative-real-interest T-bills. These are government-backed treasury bonds on which investors are guaranteed to lose money, albeit only a tiny amount of money — currently negative 0.33% per annum for the 5-year T-bill. Nevertheless, investors around the world (and in America) clamor for all the T-Bills the Fed can issue. Why? Because investors realize it’s worth losing a tiny amount of your money to park it in a secure repository like U.S. government-backed dollars. Much better in these days of economic upheaval to lose a tiny amount of your life savings than to invest it in something like the Saudi riyal and risk losing everything if that despotic regime suddenly gets overthrown by another Islamic fundamentalist revolution.

Also, FM is as usual correct when he points out that the so-called military “cuts” caused by the sequester are more show than reality. In actual fact most of the military funding has now been exempted from cuts, including pay for serving military personnel, military pensions, the most important weapons procurement contracts including the F-35 joint strike fighter and the new round of nuclear aircraft carriers, and the navy’s new littoral ship.

See Ezra Klein’s article “The Sequester’s Defense Cuts Aren’t That Scary, In One Graph,” 20 November 2013, for more details.

Thomas,

Thank you for going over this. I have discussed the reserve currency myths so often I’m bored with it. And explation so are futile.

However, since you were generous enough to start, I will add a few details.

China does not want the RMB to be a reserve currency. In fact, nobody sentient does. Most of the world’s economically strong nations carefully manage the value of their currency — difficult to do for a reserve currency — and most of them want it weak. Like Germany and China.

The loss of status as “the” reserve currency might be destabilizing — or not — but it would allow the US dollar to decline in value, and so help balance our trade deficit. A big benefit for the US.

About those large US dollar holdings by other nations’ governments. They do not hold USD as a store of value, or as investments. These are the result of mercantilist strategies, to keep their currencies cheap and so boost exports. As is happening with Japan and China, these imbalances go away on their own, eventually.

dollar as percentage of global reserve peaked in 1999

http://en.wikipedia.org/wiki/Reserve_currency

morse,

“dollar as percentage of global reserves”

That’s appropriate. The US has neither the greater share of the world’s land, resources, or population. As the emerging nations grow, joining the community of developed nations, the US share of the world’s financial system will shrink.

That was the goal of the West’s leaders when they laid the foundation of the modern world’s systems after WW2. That goal distinguishes the US from past hegemons, who were interested purely in exploitation and domination.

(2) You cite Zero Hedge. The people running that site are brilliant, combining massive copyright infringement (copying research reports) and gross misinformation to build advertising revenue. Their original content and much of their reposted blog content ranges from misleading to wrong.

Unless carefully read — most easily by attention to the copied reports from major research sources — it will make you dumber and more ignorant, day by day. Most of their major themes have proven totally wrong since the crash: forecasts of economic decline, rising interest rates, rising inflation, rising Federal deficits, and rising gold prices. That their loyal readers don’t know this is sad. Really sad.

“forecasts of economic decline, rising interest rates, rising inflation, rising Federal deficits, and rising gold prices. That their loyal readers don’t know this is sad. Really sad.”

economic decline is obvious to any sane observer. US 10-year treasury yield has increased from 1.6% in dec 2012 to 2.74% today, 3% is considered a red line. Inflation and federal deifict has been mitigated by the shale revolution which help US reduce import oil imports, but that wont last very long.

“Shale’s Effect on Oil Supply Is Forecast to Be Brief“, New York Times, 13 November 2013

Gold price is up 50% since the beginning of the great recession.

On the other hand predictions of QE stimulating the economy has been any unmitigated failure. And blown a massive bubble in stock that is at least 50% overvalued.

Morse,

“economic decline is obvious to any sane observer.”

This is almost too dumb to comment on. Almost every economic measurement has shown steady slow growth since the trough in 2009.

” US 10-year treasury yield has increased from 1.6% in dec 2012 to 2.74% today”

Normalization of interest rates is a sign of growth, not decline.

“Inflation and federal deifict has been mitigated by the shale revolution”

You are just making stuff up. The various CPI subindexes have been in decline for several years. The core measures, which do not include energy, ditto. The shale “revolution” is significant, but has a trivial effect on the Federal budget.

“but that wont last very long.”

That’s a subject of debate among experts, with the answer as yet unknown.

I am moderating your future comments. Anything citing evidence or expert analysis will go thru. This stuff, no. It’s a waste of readers time.

wrong, the future of US is venezuela

“Venezuela hit by fears of hyperinflation and recession“

All those trillions of dollar printed by fed is now sitting idle like bottled up potential energy, but one day they will explode.

Morse,

(1) Please post one consolidated comment in the future, not a stream of consciousness series.

(2) “like bottled up potential energy … will explode”

That’s a daft analogy. I assume you refer to the possibility that the excess reserves in the banks will “explode” into lending? By what mechanism?

As the BoJ showed in 2006, excess reserves can be quickly drained from the banking system.

morse,

This would have been a useful comment if you gave some factual basis for a comparison between the US and Venezuela. As it is, your comment looks quite daft, as the US has none of the characteristics mentioned of Venezuela.

Pingback: Listen to the Slowing US Economy … | Bill Totten's Weblog

Pingback: Three Graphs Tell the Story … | Bill Totten's Weblog