Summary: We’re flooded with news from the gross over-capacity of that industry, so finding a full balanced story has become difficult. This post takes something that should be simple — the monthly jobs report — and shows how it’s spun to gibberish by Left and Right, and one way to find its core meaning.

“Unless you expect the unexpected you will never find truth, for it is hard to discover and hard to attain.”

— Heraclitus, the pre-Socratic “Weeping Philosopher” of Ionia

.

The news consists largely of narratives dressed up with tidbits from the endless stream of data washing over us. Among its many functions is to assure us that this data has meaning (beyond itself) and can be understood.

Unfortunately, American information sources often divide us into tribes by carefully selecting what to show members, and spinning what they show. So even intelligent well-informed Americans often display amazing ignorance about basic aspects of politicized issues (e.g., that skeptics deny the existence of climate change, or that Obama is not an American citizen). These trends combine to blind us to the complexity and changing nature of our world. Two politicized topics show this clearly: climate change and economics. For a change, let’s look at the latter. Conservatives seek to convince us that the economy remains stagnant, liberals (and Wall Street) that it’s begun to boom. Both have little interest in the boring reality of slow stable growth since the crash.

The first principle of stockbroker economics is that all news is good. … The second principle is that the stock market is always cheap.

— Andrew Smithers, Financial Times, 4 January 2006

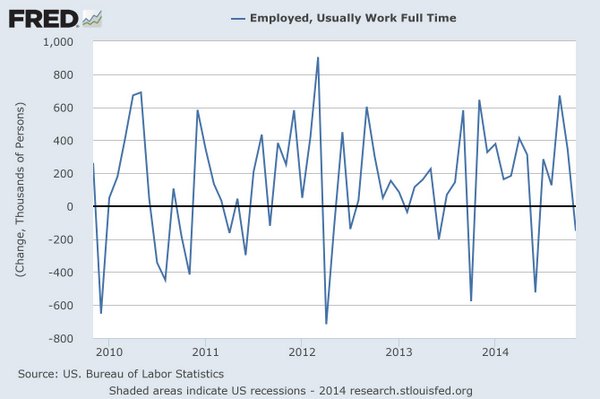

The Right points to the weak numbers in the Household report. Zero Hedge trumpets “Full-Time Jobs Down 150K“! True, and nice clickbait. But the highly volatile household data tells us little in this form.

.

.

Instead let’s look at it as percent change (which adjusts for the growing population) on a Year-over-Year basis (smoothing the line, but losing resolution of recent change). We see steady but slow growth (but at 119,482,00 still under the Nov 2007 peak of 121,875,000):

.

.

The wealth of information in the monthly jobs report usually has something for everyone. The bears point to the ugly household report numbers (only 4,000 new people employed). The cheerleaders point to jobs (fastest % growth since Jan 2012) and private sector hourly wages (fastest % growth since June 2013). Good but hardly spectacular.On the other hand wages of production and non-supervisory workers grew only slowly. Dean Baker explains that the growth might be measurement error (the data is erratic). And on and on.

How do we make sense of this numbers blizzard? To help us the Fed produces a Labor Market Conditions Index, using a model fed by 19 indicators. It paints a picture of job conditions consistent with the slow growth of most economic indicators (better than no growth). Also, like most indicators it shows no acceleration. No signs of the coming boom predicted by so many during the past 3 years.

.

.

We have to tools to clearly see our world, but they’re not always at hand. If not for spin, we’d have no news at all. As we lose interest in paying for news, we’ll rely even more on people either feeding us narratives — or clickbait (Andrew Lewis: “If you’re not paying for something, you’re not the customer; you’re the product being sold.”).

For More Information

(a) More about the jobs data from Dean Baker (bio) at the Center for Economic Policy and Research

(b) For more about jobs see November brought us good news about jobs and wages. Here are the details., 5 December 2014.

(c) See all posts about economics.

(d) Recent posts about this economic cycle:

- Are we following Japan into an era of slow growth, even stagnation?, 18 November 2013

- Has the Fed blown another housing bubble?, 30 January 2014

- Has America’s economy entered the “coffin corner”?, 10 July 2014

- Economists forecast a boom soon. The numbers show slowing. Who is right?, 21 July 2014

- See the true trend of the US economy, hidden in the daily news, 1 August 2014

- It’s not too soon to worry about the US economy. There are things worse than slow growth., 18 September 2014

- Listen to the slowing US economy, hear echoes of Japan, 24 September 2014

- 3 graphs tell the story about the US economy, hidden amidst the noise of the jobs report, 6 October 2014

- Look at the economy. Fight the illusion of normality. Feel the weirdness., 8 October 2014

.

.

Great closing quote!

How true that closing quote is. Back in the 70’s or early 80’s there would be an ad every Sunday in the paper to buy an item mail order for under $10.00 that was really worth $20.00 plus. I found out what was up when I ordered one of these offers. The stuff was good well worth the double the price. But for the next 6 years my mailbox was full every day with mail order offers. I later found out that my name was added to a mailing list of recent mail order buyers that was being rented for a single use

atup to $4.00 per name. The people were just buying my name with that offer. And it must have been worth hundreds of dollars or more to them.We certainly do have a problem both gathering and interpreting the all the data or sorting through the spin. Small wonder so many folks just choose the interpretation that fits their bias.

Even if we are capable of doing our own analysis, how do we act on it?

I suppose you could trade on it. Or perhaps it would aid in determining who to vote for in 2016.

Are many of our fellow citizens able to do this? Is it enough to make a difference to the country? Or should everyone just seek to profit from it as best they can?