Summary: Let’s again look at the data about the US economy (we cannot directly see it, of course), both the recent past (dimly seen) and the immediate future (looming ahead in the darkness). Slower growth than usual since WWII, with higher risks and more unknowns. Just as I’ve reported for the past four years. (2nd of 2 posts today)

.

Contents

- Status report

- Where we were

- Some leading indicators

- Market signals

- Conclusions

- For More Information

.

(1) Status report

For the past four years we have heard Wall Street and government (still slightly different groups) cheering the breakout economy, as we have one or two quarters of strong growth. The good times are here again! The stock market has risen on alternating periods of “the boom is coming” and “growth is slowing so buy before the stimulus” (demonstrating Rule One of Andrew Smither’s Stockbroker Economics: “all news is good news”). We had the slowdown in Q1, followed by stronger growth in Q3 and Q4. Now comes another slowdown.

How long will this continue? How long will the bottom 80%, seeing little or no growth in real wages, tolerate this without either political protest or labor action? When will the next recession come? The theory of “stall speed” says that the risk of recession increases with growth slower than 2% (a darker version is the “coffin corner“). The government appears to believe in a stall speed; since 2008 such slowdowns have been met with a combination of fiscal and monetary stimulus (except for last winter’s weather-caused slowing).

Probably we will learn soon. Conditions look a bit dark at the start of 2015: US fiscal tightening (shrinking deficits), the end of the US QE3 monetary stimulus, Europe on the edge of recession, and turbulence in the emerging nations (from falling oil prices and a rising US dollar). As I have said so often since the crash, in 2008 the world economy sailed off the map of the post-WWII world. We’re in terra incognita, the unknown land with its unknown rules. Our leaders have pretended that we’re still in Kansas and nothing has changed. I suspect that illusion will become impossible to maintain in the next recession, and that the downturn will come even more unexpectedly than usual.

(2) Where we were

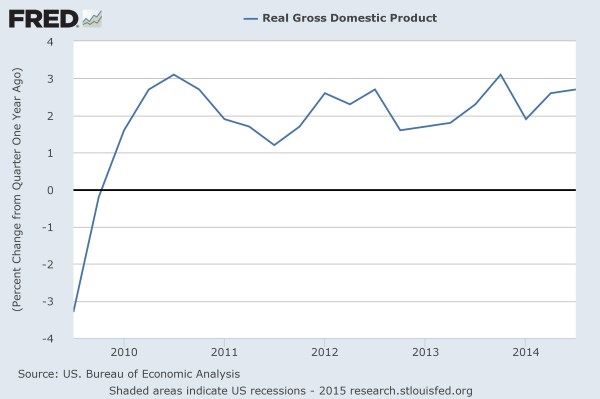

First let’s orient ourselves by looking backwards. US real GDP has grown at ~2.2%/year for the past four years, near “stall speed”. Sideways, with every breakout of a quarter or two quickly fading so that the year-over-year trend remains flattish. See the noisy quarter to quarter changes. Each breakout to 4% sparked cheers; but the sideways trend always resumed. Will 2015 see the true breakout?

.

.

The sideways trend is clearer when on a year-over-year basis.

.

.

(3) Some leading indicators

We look at leading indicators for clues to the future. Each is a dot; together they draw a picture. We only have a few so far in 2015, such as the Markit December 2014 index of its manufacturers’ purchasing manager survey: showing slowing growth, the weakest since January.

.

.

The US economy is mostly services, so we look at the less-accurate Markit December 2014 index of its services’ purchasing manager survey: showing slowing growth, the weakest since February.

.

.

Today we had one of the more important dots: the Census’ December 2014 survey of manufacturers’ new orders for core goods: shows slowing growth in a sideways trend for the past two years.

.

.

(4) Market signals

Market signals provide crowd-sourced information, reflecting the decisions of investors, households, businesses, and governments. Some of these are hard data, such as people setting prices through the buying and selling of goods. Some are softer data, such as investors buying and selling securities to act on their vision of the future.They provide an erratically accurate view of the future.

Two markets recently have given large signals. Unfortunately the tape tells us the prices at which people trade, but not the reasons. Markets provide a chiaroscuro of brights and shadows about which we tell stories. Often experts tell contradictory stories from the same data.

(a) Oil

Oil is the largest size and most-economically sensitive of the industrial minerals. Something is happening, but we don’t know what — or even what it means for the future. Have prices fallen due to a slowing global economy or because of political decisions by the Saudi Princes? We have only adequate data on oil production, and poor data for inventories (in the developed nations we have good numbers from refiners but little from end users, and little data from the emerging nations). We have even less data on oil consumption. We have almost nothing telling us about the thinking of the Saudi Princes (only a few know the truth; they seldom talk to journalists, and even less often talk truthfully).

.

.

Here’s a more useful perspective, showing year-over-year per cent changes. Note the boom-bust pattern around recessions. This 40% drop sometimes happens without a US recession. As in the 1987 false alarm, the 1997-98 bust of the emerging nations, and in 2005-2006 (a correction during one of the greatest oil bull markets, from $20 to $140). It’s a red light on the dashboard.

.

.

(b) Interest rates on long US treasury bonds

This is the ur-market, the largest and most important securities in the world. And the most enigmatic. Millions of words are written about it every year, mostly specious. Thousands of forecasts are made, most wrong. But something is happening, for these rates are without historical precedent.

.

.

(c) US stock prices

They mean little to the economy, and tell us less. Most Americans own nothing. A large number have their wealth overwhelming invested in real estate. Unless you are one of the top 10% — with a large fraction of your wealth invested in publicly traded stocks — why do you care?

(5) Conclusions

Sailing off our map makes forecasts even more difficult than usual. My guess for 2015 is that something, somewhere will disrupt the careful balancing act each of the great nations has independently maintained since the crash (USA, China, Japan, EU). Probably resulting from some economic event, like a recession which spreads. Even a minor geopolitical upset might prove too disruptive for the weak global economy (e.g., conflicts in the Ukraine, Syria, and Iraq are smaller than “minor”).

Or we — the US or the world — might break through into a strong recovery, starting a new growth cycle. That would mark a new age, since we learned that even fantastically large monetary and fiscal stimulus work without ill effects. I’d expect new economic theory, building on current models, to emerge.

(6) For More Information

(a) See all posts about economics.

(b) Recent posts about this economic cycle:

- Are we following Japan into an era of slow growth, even stagnation?, 18 November 2013

- Has the Fed blown another housing bubble?, 30 January 2014

- Has America’s economy entered the “coffin corner”?, 10 July 2014

- Economists forecast a boom soon. The numbers show slowing. Who is right?, 21 July 2014

- See the true trend of the US economy, hidden in the daily news, 1 August 2014

- It’s not too soon to worry about the US economy. There are things worse than slow growth., 18 September 2014

- Listen to the slowing US economy, hear echoes of Japan, 24 September 2014

- 3 graphs tell the story about the US economy, hidden amidst the noise of the jobs report, 6 October 2014

- Look at the economy. Fight the illusion of normality. Feel the weirdness., 8 October 2014

- Here’s help to see the truth through the narratives in the news: looking at the jobs numbers, 9 December 2014

(c) Posts about the great monetary experiment:

- The World of Wonders: Monetary Magic applied to cure America’s economic ills, 20 February 2013

- The World of Wonders: Everybody Goes Nuts Together, 21 February 2013

- The greatest monetary experiment, ever, 20 June 2013

- Do you look at our economy and see a world of wonders? If not, look here for a clearer picture…, 21 September 2013

- Wagering America on an untested monetary theory, 22 January 2014

- The easy way to understand unconventional monetary policy, 7 February 2014

.

.

“How long will this continue? How long will the bottom 80%, seeing little or no growth in real wages, tolerate this without either political protest or labor action?”

How long have the poor in Thailand endured a vastly inequitable and corrupt system? I’ve maintained for over a decade that the Thailand model is the ultimate goal of the “elites” whether consciously or unconsciously. The nation bifurcates into the haves and have-nots as it no longer becomes necessary for the top 1% to maintain a healthy and generally prosperous national economy in order to enjoy a life of riches. At least in the minds, anyway. The truth might be different.

People will go along with gradual impoverishment as long as they are coerced into gradually but endlessly choosing the slightly less better option than the one they had before. To protest would be to lose everything and would likely be useless anyway and so down they go bit by bit in a sinking spiral of the “new normal” re-adjusting their expectations along the way via the Overton Window.

Hidflect,

That’s a dark but realistic perspective on events. In addition to Thailand, look at Latin America. Much of the Southwest US is evolving like that, as described in America’s elites reluctantly impose a client-patron system.

Yes, my view was quite dark. And it’s too easy to wail and bemoan the trend of things and not suggest any real options. This is the fail-point of so many doomer/prepper websites. Their offered solution seems to be retreat to a bunker stocked with tins of beans and shotguns which is a fallback position like castles; doomed to failure. So to try and suggest something positive: the internet is really shaping up as the ray of hope with its capacity to bypass the MSM message.

As one example, I was initially depressed at CNN’s coverage of the SONY hacking scandal uncritically presenting the State Dept.’s view that N.Korea was behind the event. But lo! The internet pushed back. Dozens of websites like yours ridiculed the N. Korea angle and it became the “new cool” to be cynical and disparage this status quo nonsense. Everyone I sent a link to of your article totally endorsed the position. Of course. Millions of us may be working in “Bullshit Jobs” (as the cadence goes) but it doesn’t mean we’re any less smart than Jamie Dimon (the smug pr*ck). And the internet is the channel for the fierce rage building.

The status quo know this but they also know if they tried to mess with the freedom of the net it would tip their hand. I’m waiting for the Controllers to make a mis-step and try to lock down the web somehow. The lashback may be the flashpoint for a rebellion. Each of us has the theoretical capacity to take down a bank just from our humble home PC. In a slightly less revolutionary vein, sites like glassdoor.com already empower people with job sites that also offer feedback and commentary on companies from experienced employees. This is having a real effect in keeping companies’ practices in line.

There are no policemen patrolling the corridors of corporations unlike the streets we occupy and this has allowed enormous malfeasance to gestate like a metastasizing cancer but we, the employees, are there like flies on the wall. And we can leak however much they try to lock down the office environs.

And there is this, As Robert F. Kennedy said in 1968:

Not much progress there either.

It’s certainly a no-brainer that we must eventually have another recession. No economy keeps growing forever and ever without a downturn.

What concerns me about the next recession is that plain and simple fact that we have exhausted the means to counter such a recession. In a normal economy, GDP growth skyrockets after a recession and leads to sharply rising aggregate demand. This in turn leads to increased tax revenues and a fiscal surplus with which to combat a recession by government spending.

This recession, though, has not produced rising aggregate demand, nor has GDP growth been above-trend — in fact, GDP growth after this recession has remained very low by historical standards, as FM points out. As a result, states, counties, cities and the federal government all still run large deficits, with no extra monies available for another TARP.

Worse still, the political will in congress to pass another 2009-style stimulus seems wholly lacking. Paul Krugman remarks on this:

TARP didn’t pass the first time in 2009 and barely squeaked through the second time. That was before Republicans had total control of both the House and the Senate, which they now have. If we get another recession and there’s no stimulus spending in response, if we get another stock market meltdown and the major banks collapse but there’s no bailout passed in response, then we’re literally back to Herbert Hoover’s policies in a major recession.

We know the results of that. Unemployment shoots up past 25%, the economy craters, tens of millions of middle-class people wind up living in shacks, states set up roadblocks with armed troopers to turn away starving families at the state borders.

Can the American political system withstand that? It took 2 years of that kind of economic destruction to produce convulsions in the 1930s. Repression was tried, but it didn’t work — even general MacArthur’s troops riding down the Bonus Marchers with drawn sabers didn’t stop the irresistible political pressure for change…

Thomas,

Perhaps you are correct that the government will fail to react adequately to the next recession. I’ll take the other side of that bet.

If we escape from this cycle with no ill effects — despite 5 or 6 years of incessant confident forecasts of doom from right-wing economists — I doubt Congress will be unable to allow another downturn without prompt big action if we get a recession in late 2015 or perhaps 2016 (after a weak but longer-than-average expansion).

The deficit ballooned amidst predictions that it spending was certainly irreversible, so the deficit would increase until bankruptcy. The monetary base ballooned amidst predictions of certain inflation or hyperinflation. QE was done with declarations that it could not be ended (the right-wing clowns at Zero Hedge and elsewhere spoke of QE-infinity). All proven wrong.

I doubt that the folks in the clown car will have as much influence in the next recession.

Fabius, I certainly hope you are right. But I still have some fear of those folks in the clown car. They did not get there with out support, from the public. And many of those supporters need to use their stockpiles of food and ammunition, just to feel vindicated. I suspect there are many preppers eagerly awaiting the chaos.

Doug,

“But I still have some fear of those folks in the clown car.”

Me, too. I prefer to look to the future with faith and hope. But there are other possibilities.

From the Dept of Commerce’s advance report on December’s Retail Sales:

Down across the board from November (% change MoM SA):

.

[caption id="attachment_76404" align="aligncenter" width="390"] December 2014 Retail Sales MoM SA[/caption]

December 2014 Retail Sales MoM SA[/caption]

.

Sales ex-autos are flat from a year ago after inflation (% change YoY SA):

.