Summary: This post looks at the recent economic data, but not to convince you about the rightness of my forecast (more slow growth), but rather to help you make sense of the river of economic data the modern media brings us. As a bonus you’ll learn the secret of the new business cycle. (1st of 2 posts today.)

Economic forecasting has become much more difficult in the era that began in 2000.

We get so many confident forecasts about the economy. Some bullish, some bearish, most wrong. On the fringes of the investment industry we get people boasting about their insights, with mockery of mainstream economists, and conspiracy theories about the government’s data to explain their failed predictions.

Nor have mainstream economists won much glory. They correctly called the recovery after the strong stimulus programs began in early 2009, but have consistently and wrongly expected “take off” to “normal growth”.

After 6 years with multiple bursts of massive government stimulus, the US (and perhaps world) economy lives in crazy town. The numbers bounce around in an ever-changing nonsensical pattern of activity. The textbook business cycle clock is MIA. At the top of the swings the bulls are wrong; at the bottom the bears are wrong. So it has been this year. Economists expected a strong start with 3% in Q1, we got near-zero (which might get revised to down) — accompanied by the usual wave of bad data.

This month’s numbers have been mixed, but with two kinds of strong results. Good news, like the decent jobs growth. And great but fake news like that the Wall Street Journal (and other news media) reported this week: “U.S. home building surged in April to the highest level since before the recession officially began, a sign of thaw in the housing market during the crucial spring selling season.” It’s an example of why we know little: because we read the news.

As you can see, single family home starts “surged” by reversing their dump in March. April’s starts were almost identical to those in November 2013 and December 2014. The trend is slow growth.

By “highest since the crash” they meant rising to 40% of the pre-crash peak (and roughly half of the rate during the late 1998-2002 period). Including multi-unit homes gives the same picture.

Freight activity indexes

Instead of looking at the various sector indicators, let’s look at something more central. Nothing is more central than transportation, with multiple measures giving hard data in relatively real time. We cannot have accelerating growth without something moving fast — raw materials, imports, exports — something. The indexes draw a mixed picture, consistent with the rest of our messy data.

From the Department of Transportation we get the seasonally adjusted Freight Transportation Services Index, measuring the volume of freight carried in the US. In March it was 0.4% below its peak in November and up 3.1% YoY (Year over Year). That’s consistent with GDP and most other data.

For more current but narrower data we turn to the American Trucking Associations we get an index measures tonnage (seasonally adjusted) carried by trucks in the US. The index peaked at 135.8 in January 2015. In April the index fell 3% to a 12 month low of 128.6 (2000=100), down 5.3% from January and up 1.0% YoY. Bad news from a volatile metric.

About the US shipping data: There has been some exciting chatter about the large drop in US exports via container ships. It resulted from the strike at the southern California ports, which was resolved at the end of February. US container exports increased in April, but remain far below year-ago levels. Perhaps the congestion is taking months to unwind. Worth watching.

Conclusion

I often wonder what laypeople get by reading the financial news. It’s presented as a kaleidoscope, bewildering in its abundance, usually devoid of useful context, largely a scaffolding on which analysts and journalists hang their narrative (which often contradicts the data). What do people get from reading this daily flow of factoids?

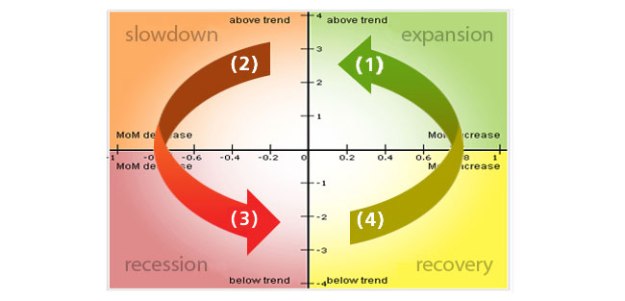

In a sense it’s always been so, but the strong cyclical aspect of the economy — the business clock — kept people’s narratives somewhat synchronized with reality. Six years of erratic slow growth sustained by bursts of government stimulus have allowed both bulls and bears free reign of their imaginations. Government stimulus plus weak growth means imminent depression, if not collapse of the dollar and perhaps civilization. Or the successful stimulus programs laid the foundation for years of powerful economic growth.

Perhaps both sides have become exhausted. With stock market valuations at nosebleed levels and gold far below its peak, the bears are either endangered or no longer bet their beliefs. The slow steady decline of economists’ long-term growth expectations (e.g., of the Fed Open Market Committee) show the bulls enthusiasm has faded as well.

What’s the secret of the new business cycle? The secret is that there is no business cycle here, just a long chaotic transitional period that began on Y2K (the real significance of that date). I believe the erratic nature of the economic data is the tell. We should be watching the data not to predict the next tick (always difficult, now impossible) but to see the emerging new economic regime when it emerges. Until then almost anything can happen. Perhaps good. Perhaps bad.

“Unless you expect the unexpected you will never find truth, for it is hard to discover and hard to attain.”

— Heraclitus, the pre-Socratic “Weeping Philosopher” of Ionia.

For More Information

If you liked this post, like us on Facebook and follow us on Twitter. See all posts about economics, about markets, and especially these about our slowing economy:

- How close are we to the next recession?

- Updating the recession watch; & what might the government do to fight a slowdown?

- Economic status report: good news plus chaff from doomsters.

- Economics gets interesting as the economy darkens while stocks bubble.

- Today’s forecast for the US economy & stock market: cooling, perhaps with storms.

- What does our surprisingly slow economy in Q1 tell us about the future?

- Update about the economy: slowing, vulnerable, in a strange space.

- About our slowing GDP: are we near a recession? are the models accurate?

The Trevor Greetham (Fidelity) Investment Clock

It worked in the post-WWII era that ended around Y2k.

FM: “I often wonder what laypeople get by reading the financial news.”

I ask other laypeople that question all the time. The uniform answer is that they don’t read the financial news. The most common answers are:

1) They believe that it is only used to sell you something and is best avoided

2) They can’t make sense of it and feel stupid

3) They’ve noticed that the financial news doesn’t seem to match their own experiences and feel it is irrelevant to their lives

Pluto,

The financial news is one of the few segments that people remain willing to pay for, so its thriving. Plus the legion of websites by professionals providing financial analysis (e.g., economic, investment) — and the far larger number run by amateurs. So either people are not giving you accurate information, or you’re asking people outside the large audience of financial info.

Perhaps you’re getting the same answer as I do when asking people “do you watch much TV?” The answer is always no. But surveys show otherwise. (I last owned a TV connected to broadcast TV or cable in 1973, although now we stream 6 shows and have many old shows on dvd).

Of course, the age old question: if you have accurate, useful information about the stock market or commodities futures, or whatever, and you want to make a living from that, why would you peddle it to others rather than invest in it yourself?

Gzuckier,

Exactly so. Most of what people fall for is inherently false.

I was a securities arbitrator for many years, hearing endless cases of doctors and lawyers whining how their trusting good natures were abused by guys on the telephone claiming the ability to risklessly double their money trading plutonium futures — so they of course mailed him $25,000.

FM, you and I are speaking of different audiences. I was speaking of the great masses of true laypeople, somebody without special interest (and usually no stake) in the financial markets.

You are speaking of the very large of people who read the newsletters and watch the shows and try to make sense of the market’s actions. As you note, the amount of newsprint and shows these people consume is vast and a bit astonishing.

I have spoken with quite a number of these people as well and have had quite interesting conversations. The reason there are so many shows and analysts is that people tend to search for information and opinions that make sense to them (stated another way, conform to the biases of the consumer), beyond that and the fact that these individuals tend to feel that the market is a bit insane (usually for radically different reasons) I have not found a common thread that has lasted for any length of time.

The most interesting comments lately have been that people are beginning to suspect that the market might be rigged against the common consumer. That it is just possible that a famous personality might recommend a stock because they have just purchased a lot of it and are looking to immediately sell it at a profit. Or observations that high frequency traders have made quite a killing. Or that banks might not be as altruistic as they present themselves. But the investors all feel like they need to keep playing the game because it is the only game in town.

Pluto,

I was not disagreeing with you. Most people don’t read financial news. But then most people don’t read the news, beyond the major headlines, celebrity news, sports, etc.

My point was that among specialty areas he financial news is among the most successful.

I was a securities arbitrator for many years, hearing endless cases of doctors and lawyers whining how their trusting good natures were abused by guys on the telephone claiming the ability to risklessly double their money trading plutonium futures — so they of course mailed him $25,000.

…….

So, how did you arbitrate such whining cases when you found people “falling” for inherently false financial schemes?

Breton

Breton,

That was an interesting but irrelevant factor in our decisions. Much of what we see as arbitrators is irrelevant.

The thing I will never quite grasp is how the people who are consistently wrong about everything having to do with business still somehow maintain their positions as very serious people and headline many of these financial publications. The past 6 years have shown in an extraordinary way, how wrong many of them were. Simpson-Bowles , Larry Kudlow, and the other hacks posing as those that have the answers whom if you invested on their advice you’d be parted with that money.

The former business cycle no longer exists because the largest appropriator, Congress has refused to do their job, now being a group of know nothings and ideologues who think that the way to achieve small government is to cut off funds that any business cycle would depend on. When you have leaders of the anti-spending movement whose job experience consists of being a flight attendant, what do you expect. The US creates its currency, you must pay taxes in that currency…nothing else. Taxes you pay validate that currency. We will never run out of currency to pay our debts. They are killing the current business cycle before a new one can even take hold.

Scott,

(1) “how the people who are consistently wrong about everything having to do with business still somehow maintain their positions as very serious people”

That is the great question. And it’s not just business and economics. Just as true about health care and foreign affairs. Our wars since 9/11 provide ample evidence of this, as the people who have consistently wrong for 14 years remains stars to journalists, while those who were right are nobodies. See this afternoon’s post for one answer.

(2) “The former business cycle no longer exists because the largest appropriator, Congress has refused to do their job”

I understand what you point to, and it’s important. But Congress is not now and has never been a major driver of the business cycle. The reasons for this odd period since 2000 lie elsewhere, and are debated by economists. I don’t pretend to understand the details, but strongly believe it is a symptom that we’ve entered a transitional era between the post-WWII regime and the new one that lies ahead. I have said this during the past decade, and this simple insight has produced quite a few accurate forecasts.

(3) “Congress … now being a group of know nothings”

No, no, no! There are few jobs in America more difficult to get than a seat in Congress. These people are political technicians of the highest caliber. It’s a system that rewards people with a specific skill set and immense dedication (they’re all workaholics). They often know little about public policy, a flaw in our system going back to the early days. If we wanted technocrats in Congress, we would elect them to Congress.