Summary: Maximilian Forte reviews Robert Reich’s powerful 2015 film about one of the great forces molding a new America — rising inequality.

“A great democracy has got to be progressive or it will soon cease to be great or a democracy.”

― Theodore Roosevelt’s New Nationalism Speech on 31 August 1910.

“Robert Reich’s “Inequality for All”: A Documentary Review“

By Maximilian C. Forte, Professor of Anthropology.

From Zero Anthropology, 28 February 2018.

Reposted with his generous permission.

Why is there growing inequality in wealth distribution in the US? Is inequality inevitable? If inequality is inevitable, can it be useful? Can inequality become a problem? If so, when does inequality become a problem? How can a society reduce problematic inequality? Which model of growth should the US be emulating? What are the keys to economic growth? What is the role of the middle class? Why has the US middle class lost so much ground since the 1970s?

These are some of the main questions addressed in Inequality for All (2013), a documentary by Robert Reich, the former Secretary of Labour in the Bill Clinton administration (see the website for the documentary, and its resources page). It is essentially an elaborate remix of lectures given by Reich in his “Wealth and Poverty” class at UC Berkeley, with ample illustrations, interviews with workers and CEOs, and some of Reich’s life history and memories of working in the Clinton administration.

These are some of the main questions addressed in Inequality for All (2013), a documentary by Robert Reich, the former Secretary of Labour in the Bill Clinton administration (see the website for the documentary, and its resources page). It is essentially an elaborate remix of lectures given by Reich in his “Wealth and Poverty” class at UC Berkeley, with ample illustrations, interviews with workers and CEOs, and some of Reich’s life history and memories of working in the Clinton administration.

Among the documentary’s strong points are that it is generally informative and raises some important questions. Reich comes across as a modest, straightforward, and entertaining person with a capacity for self-deprecation (especially with frequent jokes about his height). It is almost as if Reich’s physical structure resulting from Fairbanks Syndrome, and his vulnerability to bullying, preconditioned his critical awareness of social structures of inequality.

While the film is not a harangue, it clearly has a political agenda—proclaimed support for the “the middle class,” within a framework of capitalism, with some regulatory reform and welfare provisions added. The film’s message only appears radical when contrasted with the extremism of trickle-down, free market economics. The title may therefore be a little misleading, since it could suggest that the film will present a caustic critique of capitalism: whereas socialism preaches equality for all, capitalism actually delivers, only it delivers inequality for all. However, such an impression of the film would be mistaken. In the film Reich pulls back from a condemnation of inequality as such: he argues that it can never be eliminated, and it can even be useful and valuable.

Reich has nonetheless been a consistent critic of neoliberal capitalism, a fact which has distanced him from the Clinton group, and which in some regards brings him closer to Donald Trump, and much closer to Bernie Sanders.

Even in his writings (apart from his recent turn to hysterical excess, which ironically defends the elitist delegitimation of Trump voters), Reich’s brand of anti-Trumpism has repeatedly emphasized that the best way to confront today’s Trump and avoid more Trumps appearing in the future, is by adopting the kinds of social and economic policies that do not create the kinds of crises that made Trump possible, even inevitable. In this, Reich favours political economy over the sterile form of identity politics that has become prevalent in the US. He thus directs criticism at the neoliberals among his camp, and blames them rather than some imaginary “Russia collusion”. This tends to bolster his credibility as a sensible and sober critic—at least until the very recent turn in his writing, as already mentioned.

Certainly Reich is one of the more intelligent critics (usually) among the liberal-left, and his focus on inequality, labour, and consumption issues ties in well with the currently renewed awareness of super-elites, the “new American aristocracy,” and the related rise of new monopolies; the continuing critique of income inequality; discussion of how trade globalization has worked to undermine the US working class; consideration of working-class support for populism; and, a continuing concern with the “rust belt” and fixing America’s “forgotten places”.

Inequality for All sits in the same group as other documentaries that were recently reviewed here, including The China Hustle and Inside Job (with more to come on related themes). What it has in common with them is a focus on massive wealth transfers to the financial class, mention of stock market scamming, and a spotlight on the economic ills spawned by globalization. To a far greater degree than the other films mentioned, Reich focuses more on inequality, labour, and production.

Strikingly, Reich also has a “make America great again” message in his film, and his “great America” lies largely within the exact same time frame of Trump’s reference to the past. However, whereas Trump mostly prioritizes capitalists as the agents of growth, Reich instead focuses on labour. Somewhere out there must be a third film, which is a synthesis of these two approaches. (Donald Trump himself makes a brief appearance in this film, reminding us of how the media built recognition of his name brand: he was the go-to billionaire ready for media commentary on business issues.)

Let’s get into some of the key details, strengths, and shortcomings of this film.

Basic Questions, Key Answers

The film, along with the accompanying slides which are featured in the film (see the package below), is structured as answers to three key questions:

- What is happening in terms of the distribution of income and wealth?

- Why?

- Is it a problem?

Peak Inequality.

The empirical core of the documentary is presented in the correspondence between inequality and financial instability, with the language strongly suggesting that inequality causes instability. Reich begins by pointing out that,

“The typical male worker in 1978 was making around $48,000, adjusted for inflation, while the average person in the top 1% earned $390,000. Now fast-forward. By 2010, the typical male worker earned even less than he did then [$33,000], but the person at the top got more than twice as much as before. Today the richest 400 Americans have more wealth than the bottom 150 million of us put together”.

He then turns to the research of Emmanuel Saez and Thomas Piketty who looked at IRS tax data going back to 1913. They found two peak years, where the top 1% were earning more than 23% of all income—those two peak years for income concentration were 1928 and 2007. In both cases, the year following the peak was marked by a financial crash. What does inequality have to do with it? Reich’s point is that two bubbles—the products of inequality—both popped, leading to the financial crises:

“As income got more and more concentrated in fewer and fewer hands, the wealthy turned to the financial sector, and in both periods, the financial sector ballooned. They focused on a limited number of assets: housing, gold, speculative instruments, debt instruments. And that creates a speculative bubble in both times. We also know that the middle class, in both periods, their incomes were stagnating, and they went deeper and deeper into debt to maintain their living standards. And that creates a debt bubble”.

Reich also explains that, “if the wealthy are not paying their fair share and if the middle class are basically stagnant and are not paying much in taxes because they’re not making much money,” then what usually results is a budget crisis at some point.

Middle Class Consumers.

The theoretical core of the documentary revolves around a single proposition: “what makes an economy stable is a strong middle class”. As Reich explains, “consumer spending is 70% of the United States economy. And the middle class is the heart of that consumer spending. So it’s your middle class that keeps the economy going”. At this point in the film we still do not know what the “middle class” is, from where it originates, and whether it is self-sustaining. For now all we know is that the middle class is great at doing one particular thing: consuming.

As Reich speaks of the middle class, the film shows a construction worker, a doctor, a teacher, and possibly a bank teller, which are meant to suggest middle class positions. These are mostly workers (except for doctors, who may own their own practice). Reich does mention the “working class” in his film, but then quickly reorients discussion to focus on the middle class—and he argues that it is this class, the middle, which has seen its fortunes decline the most.

As Reich speaks of the middle class, the film shows a construction worker, a doctor, a teacher, and possibly a bank teller, which are meant to suggest middle class positions. These are mostly workers (except for doctors, who may own their own practice). Reich does mention the “working class” in his film, but then quickly reorients discussion to focus on the middle class—and he argues that it is this class, the middle, which has seen its fortunes decline the most.

How so? The vignettes shown are of individuals who are blocked in their quest to consume more: several speak of difficulty buying a house, or even a smartphone. One of Reich’s representatives of the middle class is someone who works at COSTCO (her husband is unemployed), and they live with friends. This then provoked two questions for me as a viewer: if workers are also part of the middle class, then is it not true to say that workers’ positions are deteriorating? Or does Reich mean to suggest that the working class is doing better than the middle class?

The film thus creates confusion. More on this later.

The Top 1%: Not Very Useful.

“The problem isn’t that the rich spend too much of what they earn,” Reich argues, “it’s actually, paradoxically, that they spend too little. They’re not generating enough economic activity”. Reich explains: “Somebody earning $10 million a year doesn’t spend $10 million. They save it. And those savings go anywhere around the world. They can make the most money, get the highest return. They become part of the global capital market, including a lot of speculative instruments”. Reich is backed up by a supportive venture capitalist and pillow manufacturer, Nick Hanauer (yes, Reich was ahead of Trump in having his very own MyPillow guy). Hanauer himself states in the film, speaking of the profits he makes on investments: “most of the return that’s being created isn’t creating any kind of social utility”. Hanauer also debunks the rich-as-job-creator myth that dominates right wing corporate theology:

“The problem isn’t that the rich spend too much of what they earn,” Reich argues, “it’s actually, paradoxically, that they spend too little. They’re not generating enough economic activity”. Reich explains: “Somebody earning $10 million a year doesn’t spend $10 million. They save it. And those savings go anywhere around the world. They can make the most money, get the highest return. They become part of the global capital market, including a lot of speculative instruments”. Reich is backed up by a supportive venture capitalist and pillow manufacturer, Nick Hanauer (yes, Reich was ahead of Trump in having his very own MyPillow guy). Hanauer himself states in the film, speaking of the profits he makes on investments: “most of the return that’s being created isn’t creating any kind of social utility”. Hanauer also debunks the rich-as-job-creator myth that dominates right wing corporate theology:

“When somebody calls themselves a job creator, they’re not describing the economy or how the economy works, although that’s what it sounds like. What they’re really doing is making a claim on status, privileges, and power….Rich business guys like me are not job creators…it’s actually our customers that are the job creators”.

This perspective helps to cement one of the film’s key messages: “The most pro-business thing you can do is to help middle-class people thrive”. The middle class is the centre of the economic universe—and in case you miss this point, the film graphically emphasizes it:

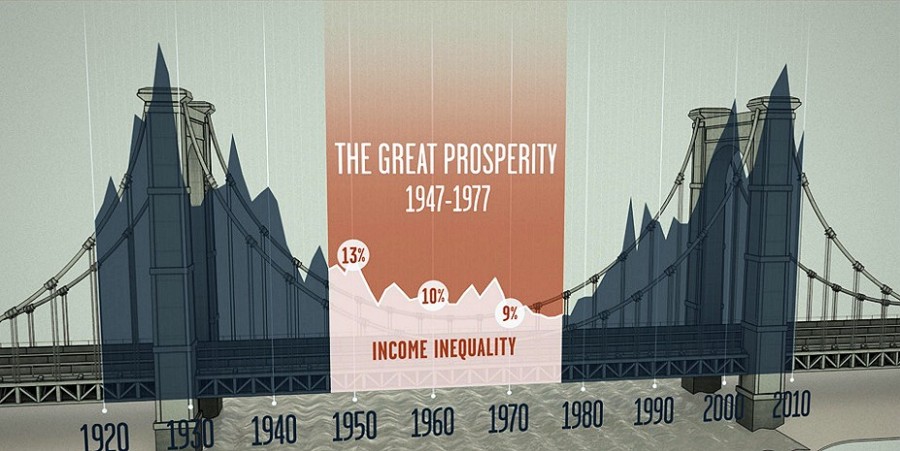

The Great American Prosperity

The last point above leads to the film’s most important message, about solutions: wherever one finds prosperity in the developed world, one will find massive investments in the middle class and the poor (in Hanauer’s words).

The central message can be summed up with one simple graphic.

This is Reich’s answer to the questions, “What nation does it better? Whom should we emulate?”—the answer is the United States (cue bouncy piano music). The three decades that came after the end of World War II, is the period that he calls “the Great Prosperity” and it is this which Reich would like to see the US regain.

How that is to be regained is explained across a range of slides at the end of this article, and by understanding his critique of how the opposite of prosperity was achieved, what we might call the Great Decline.

The Great American Decline: Globalization, Technology, Oligarchy.

The problem is not productivity: the US has experienced a skyrocketing growth in productivity over the decades, but wages did not match the increases in productivity, especially from the late 1970s onward. As Reich explains, from the late 1970s several key developments unfolded:

- most US manufacturing began to relocate overseas;

- there was a revolution in information, communication, and transport technologies;

- financial markets became more powerful;

- there was a greater move to deregulate finance and the economy; and,

- labour unions went into decline, a decline that almost exactly matched the decline in the middle class’ share of national income.

The major underlying issue here, Reich asserts, was two interrelated things: globalization and technology. As Reich states:

“Technologies like cargo ships, containers, satellite communication technologies, and eventually computers and the internet, these technologies enabled the production process to be parceled out around the world. Large numbers of American manufacturing workers began to lose their jobs, which meant it inevitably began undercutting the wages of a lot of working Americans….Factories remaining in the United States shed workers as they automated…. And we have this romantic idea that we can get manufacturing back. But you get manufacturing plants back, and they’re filled with robots and computers. The old assembly line is gone”.

Globalization and technology, Reich maintains, “haven’t really reduced the number of jobs available to Americans. These transformations have reduced their pay”. Not only wages stagnated or shrank, but costs have also risen for healthcare, education, and housing. Upward mobility thus becomes harder, and in the US 42% of children born into poverty will not get out of it, while in Denmark 25% of children born into poverty stay there—as Reich exclaims: “Even Great Britain, a country that still has an aristocracy, has more upward mobility than we do”.

What Reich also points out is that since the 1990s, particularly from the time Bill Clinton became president, there was a massive upward turn in the slope of stock market gains. He asks: “Were companies suddenly that much more profitable?” No, instead, “one of the big reasons corporations were showing higher profits is, they were keeping pay down”.

Reich’s solutions are not difficult to apprehend: increase wages, reduce costs of higher education, regulate the housing and financial markets, and keep the corporate oligarchy out of electoral politics. Reich heavily emphasizes education, the great silver bullet that Thomas Frank debunks in his book, Listen Liberal.

Faking It

How has the US managed to sustain what appears to be a high relative standard of living? Reich identifies three ways of coping with flattening or declining incomes:

- With wages stagnating (an individual wage earner cannot buy more hats), the “coping mechanism” was to have more women going into paid work (more individuals buying hats, even if they buy fewer hats as individuals).

- Both men and women would now work longer hours.

- Borrowing to finance spending—resulting in increased household debt.

Reich does not mention immigration—so see “Immigration and Capital”: a society can also maximize the size of its total labour force by encouraging trafficking in workers (otherwise called “human trafficking” or “illegal immigration”). The best way to maximize the growth in the total labour force is precisely by illegal methods, meaning that the movement is: (a) unregulated by the state, and thus not subject to political debate and legislation; (b) is unrestricted in volume; and, (c) is a situation where undocumented workers cannot avail themselves of rights under labour laws, thus rather than offshoring production to where workers are super-exploited, what we have is the onshoring of super-exploitable workers.

Breaking It.

“People who are worried about widening inequality are also worried about something else. It’s not upward mobility. It’s not even trust,” Reich comments, “they are worried about the undermining of democracy”. Reich’s very legitimate criticism is that, “when so many resources, so much money, so much wealth, so much income accumulates at the very top, that with money comes the capacity to control politics”. Reich explains that there is a strong correlation between political polarization and widening economic inequality. He tells us that, “researchers measured the distance between the median voting patterns of one party and the other party, and what they found is that in times of high inequality, you have the highest degree of polarization”. He closes this part of the discussion with a poignant remark, one with which few would disagree: “We’re seeing an entire society that is starting to pull apart”.

There are some problems here, or at least some questions that Reich should have asked. The McCarthy era, and the kind of rabid anti-communism that marked one type of polarization in US politics, happened during Reich’s “Great Prosperity” era. The momentous conflict that erupted in 1968 also happened during the “Great Prosperity,” and certainly well before Regan became president. As for money corrupting politics, this is a long-standing problem in the US, going back at least to the 1800s. When C. Wright Mills wrote about the power elites in the 1950s, he also noted that such elites had been at work since the 19th century.

The Inequality Problem.

There is a problem with inequality, according to Reich, and also a problem with how we may think of inequality. First of all, Reich does not believe that inequality can be totally eradicated, or that all inequality, or some inequality, is essentially bad:

“Some inequality is inevitable. If people are going to have the proper incentives to be productive, to work hard, to be inventive…that’s the essence of capitalism, and capitalism does generate a lot of good things”.

Such statements did not prevent Reich’s critics in the media from painting him as a “communist”—even though he explicitly defends capitalism.

Leaving that aside, the key question is: Is Reich wrong? If inequality is avoidable, where is the evidence that it has been avoided? In fact here we run up against an anthropological myth—not a myth that anthropologists as such have created or defended (though some have), but a myth that is of anthropological nature because it makes fundamental assumptions about the human condition. It is based on the idea, usually associated with European Romantics, that early or “primitive” societies were “egalitarian”.

Marx’s vision of communism was futuristic—a society, some point in the future, that would feature true equality. Both are utopian visions. Few anthropologists today would defend the notion that any society we have been able to study (either archaeologically or ethnographically) was ever truly egalitarian: in the absence of class stratification, there were other principles used to sort and divide members of society, whether by age and/or sex, for example. Thus, as far as we know, hierarchy has been universal, even if class society is the most acute and most recent form of social stratification.

There is also the question of the limits of our knowledge. When we study societies archaeologically, usually they have been societies that possessed some form of inequality that produced specialists who in turn produced enduring physical remains (ceremonial sites, pottery, weapons, jewellery, monuments, architectural constructions). If we studied them ethnographically, then we studied them within contexts produced by imperial expansion that generated all sorts of inequalities either directly or indirectly. As for species preceding Homo sapiens, we know painfully little about their social organization.

Then there is a philosophical problem: if society eliminated all forms of inequality, would it still be a society?

Rather than get stuck in such problems, Reich simply resolves matters thus: “Look, the question is not inequality per se”. Instead he argues that,

“the question is, when does inequality become a problem? How much inequality can we tolerate and still have an economy that’s working for everyone and still have a democracy that’s functioning?”

Therefore while inequality is inevitable, and may even be useful, it can also become a problem—and it becomes a problem when it creates an unstable economy and threatens the basic nature of democracy. Reich’s position is one that most of us have learned to recognize as reasonable, and it is one that easily lends itself to certain solutions we have been conditioned to think of as practical and realistic (raising taxes on the top income earners, for example).

Reich’s basic assumptions are, to identify a few, that it is a good thing for the US to regain the socio-economic position it enjoyed during the “Great Prosperity,” and that consumption should not be questioned or criticized. His reasonable, practical and realistic model hinges on a growth in consumption. If more people consume, or if people consume more, then that expands the economy, and that’s a good thing, and the best people needed for increasing consumption are middle class people. Reich does not tell us why those with less than the middle class would not have an even greater capacity to consume more than the middle class.

Reich’s position suffers from an unexamined dependency issue that has previously been critiqued on this site, a position that makes Reich a bit of a half-head. For the middle class consumption model to succeed, it requires an infusion of “investment” from elsewhere. Where does that capital come from? How is it sourced? Reich and others like him will say it comes from a combination of greater taxation of the wealthy, increased wages, and decreased costs (for healthcare, education, and housing). This is a problematic tangle, and the film does not explore it.

It’s a model that still places the owners of capital in the driver’s seat because, to mix metaphors, they are the cash cows of the system. But then how did they get that wealth, if not from the work of labourers and the spending of consumers? We now have a perfect knot: the producers of wealth in the first place should be given the wealth to sustain wealth.

So this tells me, “take a shortcut”: just make the workers the owners of the means of production. Reich’s recipe instead is to have the workers consume more, and this is where comedy comes in. This inevitably reminds me of a Monty Python skit that was featured in The Meaning of Life, where the line “people aren’t wearing enough hats” played a central role (read the exchange here, and see the clip there). Reich is about more people buying more hats, because they simply must.

Though it too can lend itself to some good comedy, I generally have little use for statements such as these, as spoken by Reich in his film: “Of all developed nations today, the United States has the most unequal distribution of income and wealth by far”. That’s great, but what does it really tell us? A society can be vastly unequal, but is so damned wealthy overall that even those in the bottommost class still enjoy a higher standard of living than people in other societies, even those of a higher class in other societies. In fact, that is the most common retort about US income inequality. Thus the statement by itself does not prove any particular point.

However, the mildly good comedy comes in with Senator Marco Rubio, who apparently considered talk of “income inequality” to be expressive of a “class warfare” doctrine one might “typically” find in a “Third world country”—and here Jon Stewart jumped in, in a clip shown in Reich’s film, to show how the US ranked globally in terms of inequality. Feigning nationalistic pride, and faking support for Rubio’s statement, Stewart points at the results and shouts at the camera: “So in your face Uruguay, Jamaica, and Uganda!” (This was when hosts of TV late shows were still pretending to be comedians, rather than the screaming moralistic harpies they are now.)

Problems of Definition and Analysis.

There are two problematic concepts that are central to the narrative of this documentary, and at least Reich is aware that they are problematic. One is the concept of “globalization”—which suffers from a glut of competing and divergent definitions, a true “amoeba word” as others have said. Reich has a memorable way of pointing to the problem of defining globalization: “Rarely has a word gone so directly from obscurity to meaninglessness without any intervening period of coherence”. He nonetheless uses the term, and in the context of his film it refers to the globalization of production, trade, and consumption.

Reich’s focus of concern is the “middle class”. However, neither he nor the workers he presents in interviews, have any real definition of the term, other than an intuitive sense of comfort, or in Reich’s case, trust in an abstract number. At one point in the film, Reich states:

“There is no official definition of the middle class. But Alan Krueger, chairman of the Council of Economic Advisors, these are the percentage of households with annual incomes within 50% of the median household. $50,000, median income, 50% above, 50% below”.

Besides being a garbled statement, the problem here is that class is being defined solely in terms of income, using an arbitrary figure at that. What if I owned a small factory (and am thus a capitalist), but given problems with demand, my poor management, or other factors, I make so little that it places me within striking distance of the median income? What if my debts exceed my profits, does that fact change my class position?

Reich’s “middle class,” as presented in the form of actual individuals speaking in the film, appears to consist of a particular kind of worker: the one whose wage allows a family to survive above the poverty line. Thus the figure of the single mother, working at Dunkin’ Donuts, earning the minimum wage and unable to make ends meet, is not the kind of worker at the centre of Reich’s concern. Middle class, we can intuitively figure out, means something like “not the working poor”.

One’s position in relation to the means of production, whether one owns capital, or one only has labour power to rent out, appears to be “too Marxist” a way of organizing information for Reich. And the problem is this: if you cannot properly identify a “middle class,” then how do you go about facilitating the growth of the middle class? Since the “middle class” is Reich’s key to solving the problem of instability and the inequality that causes it, one would have to conclude that he does not really have a solution.

At any rate, Reich is a former Secretary of Labor and a top professor at one of the US’ top-ranked universities, and it would therefore be right for us to expect a lot better from him. Instead we get this garbled mess of definitional obscurity, confusion, imprecision, of questions never raised and assumptions never tested. At least Reich spares viewers by not fooling them with tedious liberal clichés about “working families”.

Conclusion.

On the one hand, this is a film that could be useful for undergraduate courses in political economy, globalization, and contemporary American sociology; also, even five years after its release it remains timely and relevant—especially as the basic problems of 2008 have not been resolved, and in some respects have worsened. On the other hand, this film has a fairly narrow political point of view; the commentary is often generic, predictable, and simple; some important analytical problems are left unexamined; and, the film is often not very engaging to watch. With these two sides in mind, I cannot rate this film higher than 6/10.

Note.

This documentary review forms part of the political economy series on Zero Anthropology. Each documentary is viewed at least four times before a written review is published. All images in this article consist of stills from the film, “Inequality for All”.

Buy or rent it at Amazon.

—————————————-

See the trailer

About the reviewer

Maximilian C. Forte is a Professor of Sociology and Anthropology at Concordia University in Montreal. He is the author of numerous books, most recently Slouching Towards Sirte: NATO’s War on Libya and Africa (2012) and Emergency as Security (New Imperialism)

(2013). See his publications here; read his bio here.

He writes at the Zero Anthropology website. Many of his articles are posted at the FM website).

For More Information

If you liked this post, like us on Facebook and follow us on Twitter. See all posts by Professor Forte, about economic inequality, and especially these…,

- Why Americans should love Tolkien’s Lord of the Rings – we live there,

- Why Elizabeth Bennet could not marry Mr. Darcy. Nor could your daughter.

- The coming big inequality. Was Marx just early?

- Back to the future in New America: our new class structure,

- Education, the glittering but fake solution.

- Well-meant minimum wage increases will accelerate automation.

- A guaranteed minimum income: faux solution for the new industrial revolution.

- Why a guaranteed minimum income will not defend us from the coming automation wave.

Two books to help us understand what is happening to America.

Slow economic growth drives these social tensions. To understand the problem read The Rise and Fall of American Growth: The U.S. Standard of Living since the Civil War by Robert J. Gordon (Prof economics, Northwestern U).

Listen, Liberal: Or, What Ever Happened to the Party of the People? by Thomas Frank.

The left is desperate to find a wedge. Knowing that the poor are steadily getting wealthier in terms of purchasing power, watching as identity politics comes back to bite them, and seeing the global warming narrative sink below the horizon, they need some new folly to follow. The inequality narrative is the answer. It does not need to be taken seriously, but does deserve to be mocked mercilessly, with the poor in America being shown to live lives of which 95 per cent of the rest of the world can only dream.

And 98% of the “poor” households even have a refrigerator…

NB,

Wow. I suggest that you watch the film. You’ve either closed your eyes to the message or are commenting without reading the review.

Hint: it’s about the middle class, especially what used to be called the lower blue collar class. There is nothing in it about the poor.

Still, your was a nice if silly attempt at rebuttal.

“Quit complaining, you’re better off than a Sudanese beggar!” is a great Republican campaign slogan. Can’t wait to see how that one goes over. Especially when millions of Americans have a living memory of a much more equal society. Telling people who live in the richest country in the history of mankind that they should just be grateful their children don’t have to eat out of a trashcan is election gold.

It’s always interesting to see who this argument is deployed against. The same quarter that thinks you can’t be poor if you own a refrigerator would be angry if a similar argument was used for taxing the rich or abolishing inheritance. Taxing Jeff Bezo’s wealth at 99.9% could be justified with “He’s still better off than most Americans, and he has a refrigerator!”

Skovorodo,

Wow. That’s a brilliant comment. Thanks for posting. I hope you do so again.

“He’s still better off than most Americans, and he has a refrigerator!”

That’s got to be a winner for Best of Thread.

Good discussion of an important topic. Thanks.

Reich is a child both of the university professor class as well as of the government bureaucratic class. His words should be viewed from that perspective. To a hammer, everything else seems to be a nail. Just so for the professor, the lawyer, and the labor bureaucrat.

In an ideal world, people such as Robert Reich would not exist at all, since there would be no need for that type of career critic of culture and society.

I have followed Reich for many years, first as an admirer, but with a more and more jaundiced eye as the years go by, and Reich seems not to have learned or grown from events.

It is clear that Reich has become a fixed part of an established order which he profitably exploits, and clearly never wants to see that order be made obsolete. Unfortunately, to actually make things better that is exactly what will have to be done.

Schumer,

“It is clear that Reich has become a fixed part of an established order ”

That nails it. I had seen this, but not so clearly as you express it!

“In an ideal world, people such as Robert Reich would not exist at all, since there would be no need for that type of career critic of culture and society.”

True. But the only path to that is death (Heaven is great, so I’m told). Down here we’ll always need critics of society.

The Dems are just as much about the rich and Wall Street. Difference is they lie about it and many of those who vote for them are morons – literally.

I recommend the Dems use the “Abort, Don’t Deport” slogan for 2020.

All the evidence is there. The middle class is making less and the necessities of life are more and more expensive. Housing and rental costs have skyrocketed in the Portland area, and the homeless here like free range chickens. Soon we will San Fran North.

Gute,

“Soon we will San Fran North.”

I’ve written a little about this, one of the most interesting developments I expect in the next generation: the bankruptcy (ie, financial, social) of the Democrat-run cities and States. Mass, NY, NJ, CT, IL, and many areas on the West Coast.

The effects of this will be big, but imo almost impossible to foresee.

Gute, the middle class is doing ok in a lot of places. If they choose to stay in Portland, where it’s drifting out of reach, that’s kinda on them.

Dark,

I’ve never understood the American esteem for running away. IMO we should applaud the people who stay in Portland and fight to save their community from the Leftists ruining it.

Well, you call it “running away,” but you could also frame it as “running towards opportunity.” Go West, Young Man! That said, I would also think the better of someone who tried to fight the insanity in Portland if they are going to accept the hardships it entails. Is it worth ruining your life over?

Two random points.

I recently read an article online that said ca. 50% of American’s could not cover a $400 emergency. I think that is telling.

I read another article that said again ca. 50% of the millenials will do worse than their parents.

If true, I find both disturbing.

Sven,

Both are true. I don’t recall the number, but roughly 60% or 2/3’s of Americans couldn’t cover (without debt) an emergency of a few thousand dollars.

The downward mobility of the Millenials, as a generation, is almost locked in now. The plight of those that follow them looks worse, unless conditions change.

It’s a New America, being built on the ruins of the old while we sit on our butts — enjoying entertainments, booze and drugs. It is the reward Nature’s God gives to apathy.

I think Reich is spot on in his 3 facets of “faking it.” In his linked article (How To Stop Trump), I’d bet that most of the worker’s issues with “getting ahead” and “I can’t get anywhere” are in large part due to faking it too hard. This is tied into how 50% of Americans can’t even save up $400. Reich seems to miss the connection and continues saying that we should consume our way to prosperity, when the real solution is for these people to make better choices so that they can save some money and begin an upward trajectory.

I agree that a LOT of Millennials are fucked now. Ones with lots of debt (incurred for a stupid major in college with no ROI potential) and that are making bad choices (living in expensive, trendy urban areas they can’t afford).

Dark,

I suggest getting out of your bubble. Volunteer to hear some of those people you sneer at.

As I social worker I knew many people working long hours – often 2 or 3 jobs, minimum wage & no benefits & irregular hours — who were always one step ahead of disaster.

In San Francisco a large fraction of the population had to either live like ants or with bone-crushing commutes to work.

When I worked in Northern Appalachia, staying afloat took luck and prayer for a large fraction of the locals. Living in shacks and trailers was no fun in the Penn and NY winters.

I grew up in Appalachia and spent most of my life there, and I’ve also lived in other poor areas of the US and know people from all walks of life. However, I realized that nobody was forcing me to stay, so I moved to where jobs were (several times).

So the San Franciscans who were living like ants.. were they there honorably fighting the Leftists, or could they have chosen to move somewhere else where they could live a better life even if they worked at McDonald’s?

By the way, I am NOT sneering. I help people struggling with finances and budgeting in real life if I can. They usually ARE screwing up somewhere. Life’s not always fair, but the least you can do is not shoot yourself in the foot.

Dark,

I guess everyone just isn’t as great as you. Certainly not in their self-esteem.

In one reply (and many articles), you disparage apathy and helplessness, then in the next you ad hominem me for doing the same thing. That’s how I know you’re just being contrarian to fuck with me.

:)

Median home price Jan 1970 $23,600 Jun 2018 $302,100 (us census data). 23.600 1970 $ now are 157508 $ (Bureau of Labor Statistics): so cost of home doubled. in 1975 a new car cost 3800 ie 18 537 2018 $. today new car is (2017) 33560 ie little less than double. in 1970 lower 20% of family have an income of 16.907 (us census Table F-3. Mean Income Received by Each Fifth and Top 5 Percent of Families, All Races: 1966 to 2016) in 2016 18.202 next 20% of family keep 37.384 in 1970, 44.943 2016. so

how can be that “poor are steadily getting wealthier in terms of purchasing power” if cost of home and car (and maybe Others not-discretionary item) are doubled and family income don’ t make the same?

“One driver of home prices is size. In 1950, the average home size was less than 1,000 square feet with two bedrooms and one bath, according to the NAR. By the early 1970s, the average home had increased to 1,500 square feet.

Today, the median new home size is nearly 2,500 square feet, with most homes featuring at least four bedrooms and three or more baths, the Census Bureau reports. And all this is in spite of the fact that family size decreased from 3.37 members in 1950 to 2.5 members in 2016.”

https://www.daveramsey.com/blog/housing-trends

I believe being able to assume debt is considered a form of purchasing power. MikeF also points out an issue with what housing is being built at all – I think I read in one of Jim Hightower’s books that the developers are able to make money on small houses, but the profit margin is lower per-unit and as a result almost everything built is luxury stuff. This problem in specific, at least, people seem to be waking up to.

SF,

Hightower was kidding you. Housing supply is built to meet demand. It does not matter what homes have the highest margin. What matters is what homes people will buy. A small build-up of inventory can bankrupt a builder.

GM makes more money by building all cadillacs, but they still build more chevies.

“and as a result almost everything built is luxury stuff. ”

Somebody is kidding you.

The average house size has doubled, but are these McMasions purchased by the young or mainly by the older boomer early X gen that had the last of the higher wages?

In Australia I see the young buying the small houses, just, and the larger new houses being bought by the baby boomers.

At 55 I was made redundant at 51, basically I had to set up a company to get work and work casually in education on top, but I had finished my mortgage, when my wife and I married we bought a 970 sq ft house, built in 1950, we added a third bedroom and enlarge the lounge, for our boy and girl, if we had had 2 boys or 2 girls we would not have bothered.

We sold that and bought a house of 1725 sq ft in 2010, 1990’s built and very run down, we renovated it ourselves.

I just don’t see the young in the big houses and my business is in property development/ renovation.

As to the wealth inequality, the issue is the rich 1. don’t spend 2. take the money out the country and 3. use complex trusts and companies to minimise taxes for what is left.

The middle class spends most of the money and saves for emergencies when they have the income. This keeps the money circulating (multiplier effect), leaves savings for between jobs and they earn just too little (relatively speaking) to make trusts and companies to save taxes viable. Also they tend to be core families, and if my childhood memory is correct the ones likely to have the third or fourth child, very rare today.

I keep saying this, but we need to purchase stuff made at home, these are the simply middle class blue collar jobs. I do see the need for education, but not more University, but vocational education, since it is largely learning to learn, why not start with something practical. My eldest (previous marriage) is at Vocational Training college doing a Diploma in Engineering, studying CAD and works part time on a CNC machine at a local workshop. He will have no debt when he finishes and no experience of working in fast food like his class mates who do degrees. (I work at a University, but question the use unless you are more academic will get good grades and do a job related degree – accounting, nursing and such like).

Reich is generally about right on the analysis, it is the solution I believe he is wrong about. Too much esoteric University nonsense dug the hole, with the shovel of trickle down economics and the pick of globalisation, pontificated on by Elites who are paid out of taxes on profits they rarely make in any industry, these old ideas and ways will just make the hole deeper.

We need education that teaches people to build a ladder, vocational education, factories a fair distribution of income. Grants to set up businesses and a tax rate that is low on the real generators of jobs, at the micro end of business. Look at jobs per $100,000 investment and see who creates the most jobs per $.

I will give one example in my property business, I have a couple both Dentists, they had three trusts and a limited company, their combined income is $600,000 I know asI organised the purchase of two rental houses for them, with this clever structure and professional advise they pay less tax than I do on less that a 5th of their income.

I shall watch the film, and thanks for the reference. One of the reason I keep reading this site is the references!

Just going by the post however, the question to ask is: what about debt and credit? I may have misunderstood, but it sounds in the description as if Reich has repeated the Galbraith account of the Great Depression in ‘The Great Crash’. In this account, the problem is down to falling worker wages. The problem in a nutshell is that the workers are not paid enough to buy what they collectively make. As this develops, income and returns migrate into the finance and real estate and media sectors, and the places where they are big. At some point this leads to a collapse in demand, and…. by unspecified links …. we get a crash and depression.

The solution is therefore clear: raise workers’ wages by progressive taxation and increased government interventions in the form of transfer payments.

In neither case is there any explanation of why the situation has arisen in the first place. Its well documented that it has happened, but why in the decades around the millenium and not in those around 1960?

Surely the missing factor is the great government sponsored credit bubble? Surely this is what has had the identical effects in the twenties and in the last few decades, and surely the only solution is to get a grip of it? This would involve less government borrowing, less quantitative easing, and interest rates high enough to deter what the Austrians call ‘malinvestment’.

There is something eerie about reading the above summary of Reich’s views while having a clear recollection of Galbraith’s ‘The Great Crash’. Still regarded as a classic in liberal circles. One has the impression that the elephant is still in the liberal room, and still invisible, after all these years.

Great point George First.

Is it that in the 1960’s the West largely traded with itself and the first Asian Tigers, we largely imported only low tech stuff and the bulk of the manufacturing was still at a national level.

“The solution is therefore clear: raise workers’ wages by progressive taxation and increased government interventions in the form of transfer payments.”

I think that what you say is the question of our time, but what do we spend the money on, that we raise as taxes? Is it any old degree increasing the number of graduates with a steady decline in standard for most small universities to meet their quota, or is it business start ups, vocational education and grants to set up factories and offices in the developed, but de-industrialised nations?

I see a need for better roads and rail, factories, recycling and primary and secondary education for the masses, the working class is very under served in schools.

“‘Australia needs a raise’: wage-earners have rarely collected a smaller share of the economy” by Matt Wade in Canberra Times.

More for owners of site for an Australian perspective from the main stream, it is a paper read by the Australian Politicians and write correspondingly for them.

Just a Guy,

That’s an important point. Economic and social trends tend to be similar across the western world. It’s a small world!